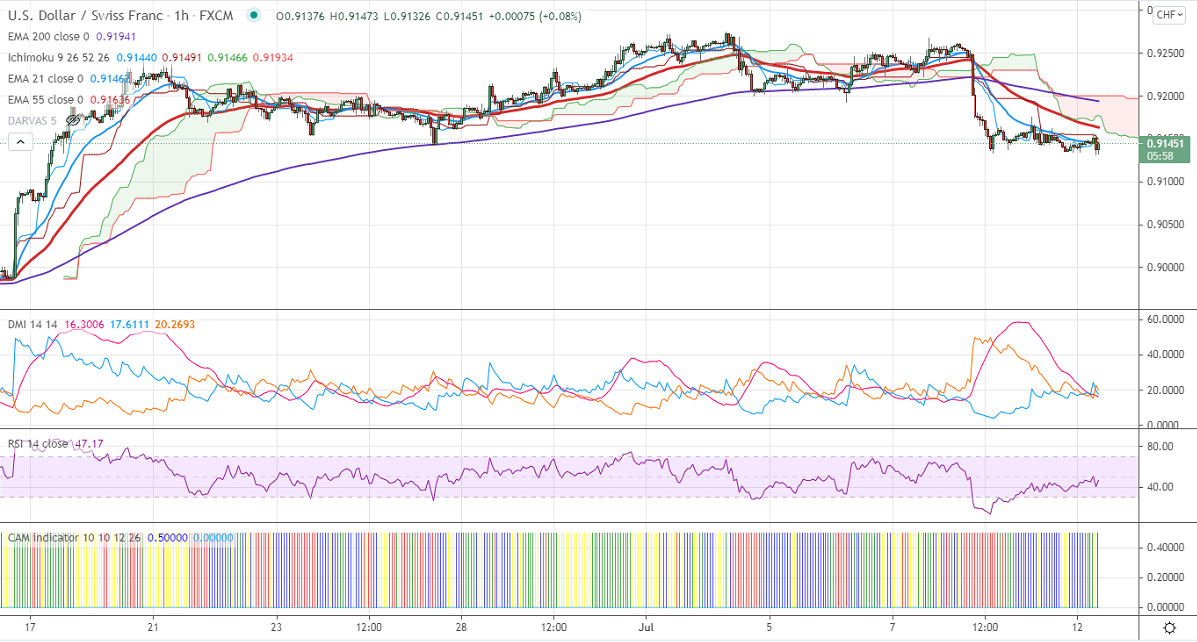

Ichimoku analysis (1-Hour chart)

Tenken-Sen- 0.91440

Kijun-Sen- 0.91535

Previous week High– 0.92676

Previous week low- 0.91330

The pair is the trading week for the past three days and lost more than 140 pips from a minor top 0.92750. The board-based Swiss franc buying due to an increase in demand for Safe-haven assets. The major sell-off in US bond yield is also dragging the US dollar further down. It has lost nearly 15% in the past three weeks and trading slightly above 1.30%. The intraday bias is bearish as long as resistance 0.9200 holds.

Trend- Bearish

The near-term support is around 0.91150, the breach below will take the pair to 0.9059/0.9000. On the higher side, immediate resistance is around 0.91625. Any convincing breach above targets 0.9200/0.9238/0.92750.

Indicator (1 Hour chart)

CAM indicator – Neutral

Directional movement index –Neutral

It is good to sell on rallies around 0.91580-60 with SL around 0.9210 for a TP of 0.9050.