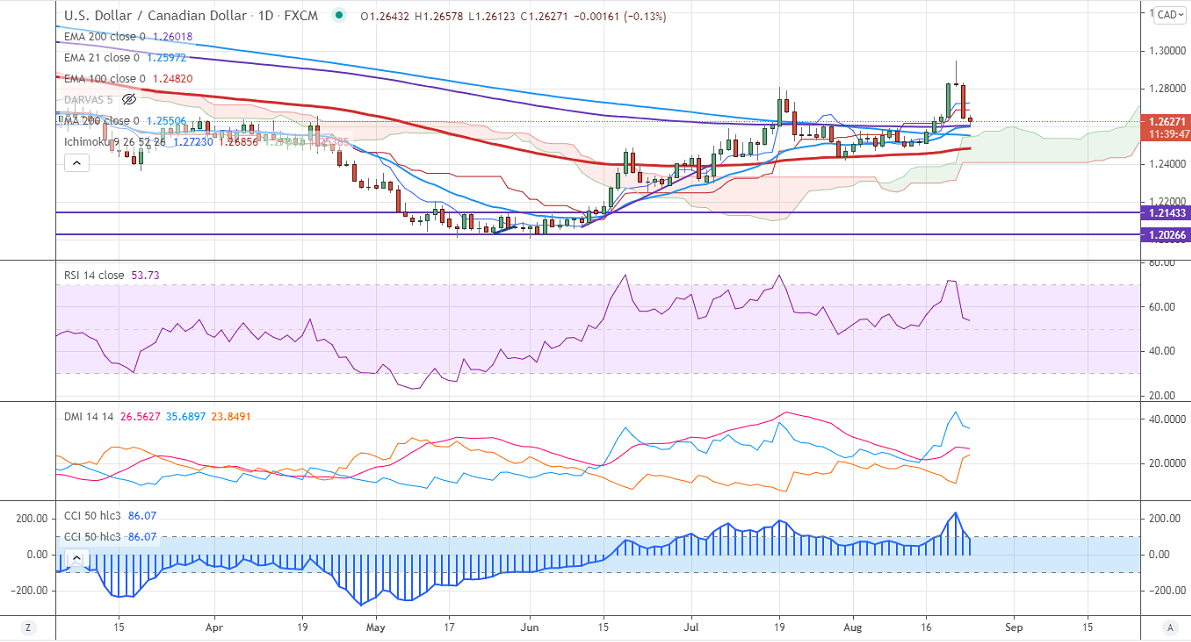

Ichimoku analysis (4-hour chart)

Tenken-Sen- 1.27190

Kijun-Sen- 1.26856

The pair has pared most of its gains made the previous week and lost more than 300 pips. USDCAD corrects for a third consecutive day on decreasing Safe-haven demand. The reasons for the decline are

US dollar reversed as the chance of tapering by the Fed is expected to delay

The minor pullback in all major commodities.

WTI Crude oil price recovered more than 7.5%.

USDCAD is hovering near 21- day EMA. The overall trend remains bearish as long as resistance 1.2950 holds.

Trend –Bearish

The near-term resistance is around 1.2660, a breach above targets 1.2700/1.2750. On the lower side, immediate support stands around 1.25980; violation below will take the pair down to the next level 1.2550/1.2500.

It is good to sell on rallies around 1.2698-70 with SL around 1.2760 for a TP of 1.2500.