- The Turkish Lira nudged up, hovering away from an over 5-month low hit last week as investors digested yesterdays better than expected economic data.

- Turkey's annual inflation rate increased to a 5-month high of 12.15 percent in January from 11.84 percent in the previous month, while producer prices rose by 8.84 percent year-on-year in January.

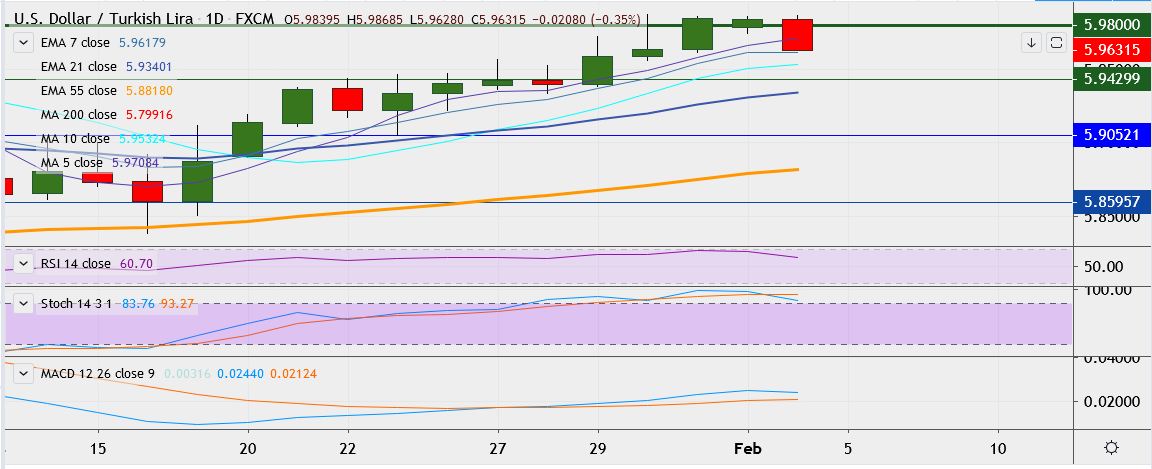

- USD/TRY is trading 0.3 percent down at 5.9668, having hit a high of 5.9873 on Thursday, its highest since August 26.

- Momentum indicators are turning bearish on hourly charts - RSI weak at 23.12, MACD supports downside and Stochs are biased lower.

- Immediate resistance is located at 5.9920, any close above could take it above 6.0030.

- On the downside, support is seen at 5.9613 (7-EMA) and break below could take it near 5.9506 (10-DMA).

Recommendation: Good to sell on rallies around 5.9800, with stop loss of 5.9870 and target price of 5.9613.