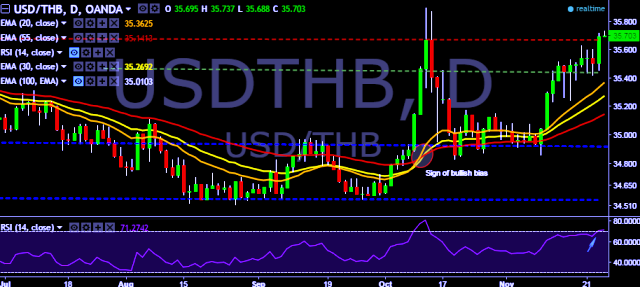

- USD/THB is currently trading around 35.70 marks.

- It made intraday high at 35.73 and low at 35.68 marks.

- Intraday bias remains bullish for the moment.

- On the top side key resistances are seen at 35.90, 36.05, 36.44 and 36.66 marks respectively.

- Alternatively, a daily close below 35.68 will drag the parity down towards key supports around 35.52, 35.23, 35.04, 34.83, 34.64, 34.51 and 34.20 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

We prefer to take long position in USD/THB only above 35.72, stop loss at 35.52 and target of 35.90/36.05.