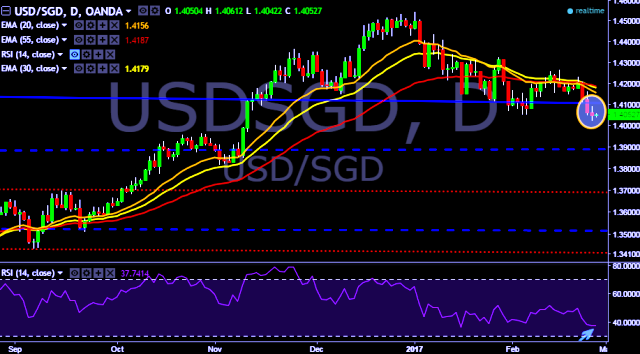

- USD/SGD is currently trading around 1.4045 marks.

- It made intraday high at 1.4061 and low at 1.4042 levels.

- Intraday bias remains bearish till the time pair holds key resistance at 1.4092 marks.

- A daily close above 1.4050 will test key resistances at 1.4092, 1.4161, 1.4205, 1.4327, 1.4409, 1.4506, 1.4568, 1.4686 and 1.4851 levels respectively.

- Alternatively, a consistent close below 1.4050 will drag the parity down towards key supports at 1.3972/1.3851/1.3775/1.3704/1.3646 levels respectively.

- Later this week, Singapore will release bank lending (Feb 28) as well as manufacturing PMI data (March 2).

We prefer to take short position in USD/SGD around 1.4055, stop loss at 1.4092 and target of 1.3972.