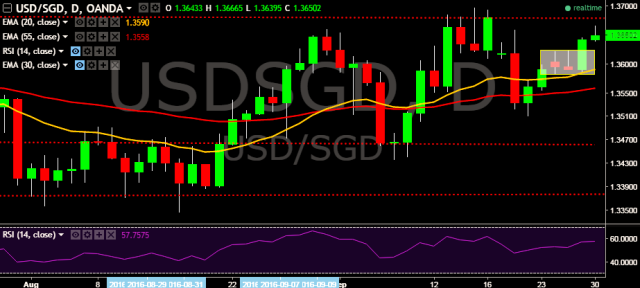

- USD/SGD is currently trading around 1.3653 marks.

- It made intraday high at 1.3666 and low at 1.3639 levels.

- Intraday bias remains bullish till the time pair holds key support at 1.3587 marks.

- A sustained close above 1.3650 will test key resistances at 1.3698, 1.3732, 1.3799, 1.3836, 1.3851(March 16, 2016 high), 1.4073 (20D EMA) and 1.4132(20D, 30D and 55D EMA crossover).

- Alternatively, a daily close below 1.3587 will drag the parity down towards key supports at 1.3510/1.3462/1.3391/1.3347/1.3313/1.3302/ 1.3271 levels.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- Singapore August bank lending s$603.9 bln-Central Bank data.

- Singapore August housing and bridging loans at s$188.3 bln vs s$182.0 bln year earlier -MAS data.

We prefer to go long on USD/SGD around 1.3650 with stop loss at 1.3587 and target of 1.3698/1.3732.