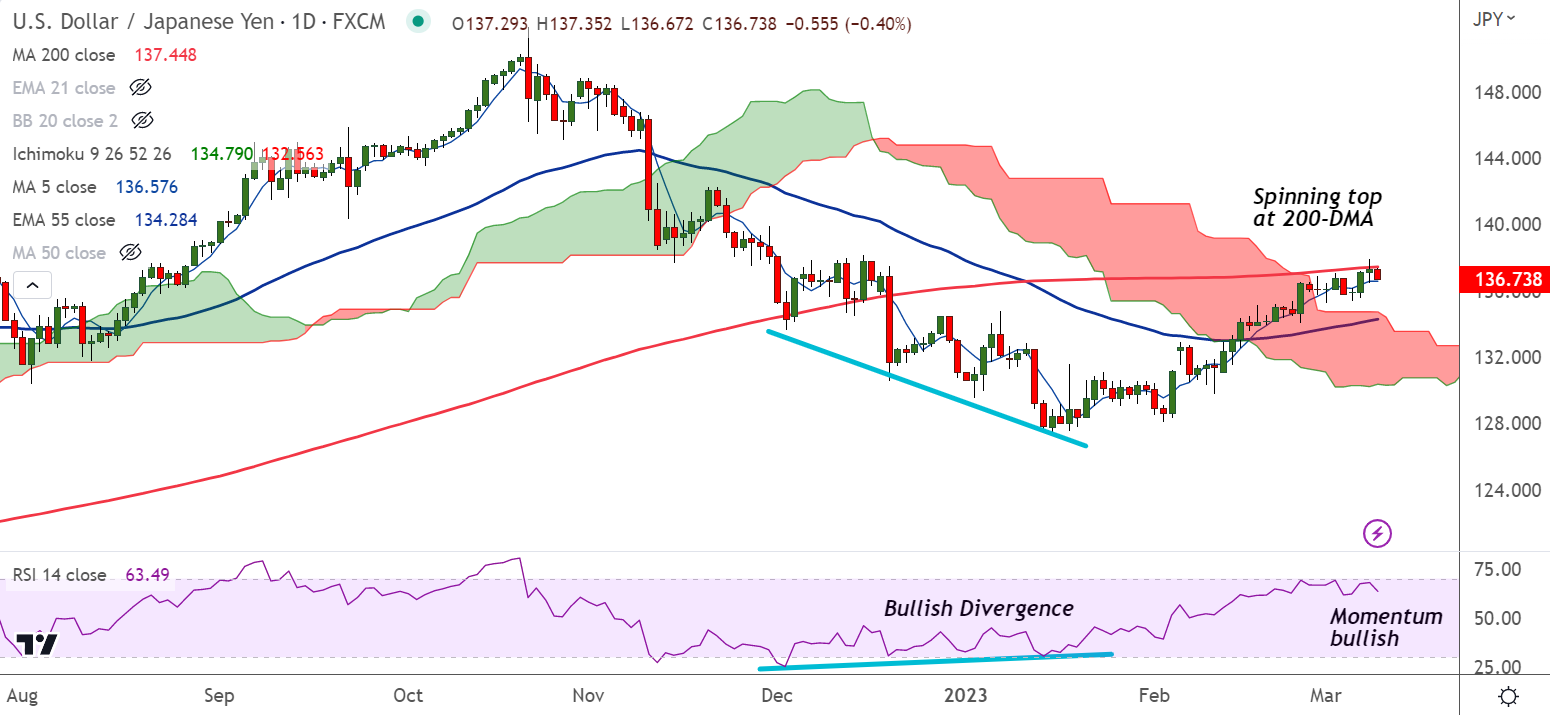

Chart - Courtesy Trading View

USD/JPY was trading 0.44% lower on the day at 136.67 at around 06:40 GMT, shows signs of exhaustion at 200-DMA resistance.

Japan's Gross Domestic Product data released by the Cabinet Office showed annualised GDP SA (QoQ) for Q4 fell to 0.1% from 0.6% prior, missing forecasts at 0.8%.

Data from the US on Wednesday showed according to the ADP National Employment report private employment increased by 242,000 jobs last month.

Further, US job openings fell less than expected in January and data for the prior month was revised higher.

Upbeat ADP report comes before February Nonfarm Payrolls data due on Friday whereby traders will be looking for the confirmation of continued strong jobs growth.

Markets expect 203,000 new jobs in February with an unchanged unemployment rate of 3.4% and unchanged average hourly earnings at 0.3%.

Federal Reserve Powell is set to announce a bigger rate hike in March to tame Consumer Price Index (CPI) and the release of the NFP data on Friday will provide more cues.

Major Support Levels:

S1: 136.55 (5-DMA)

S2: 136.41 (200H MA)

Major Resistance Levels:

R1: 137.44 (200-DMA)

R2: 138.26 (Upper BB)

Summary: USD/JPY has formed Spinning top at 200-DMA resistance denting upside in the pair. Break below 200H MA will drag the pair lower. Bullish continuation only above 200-DMA.