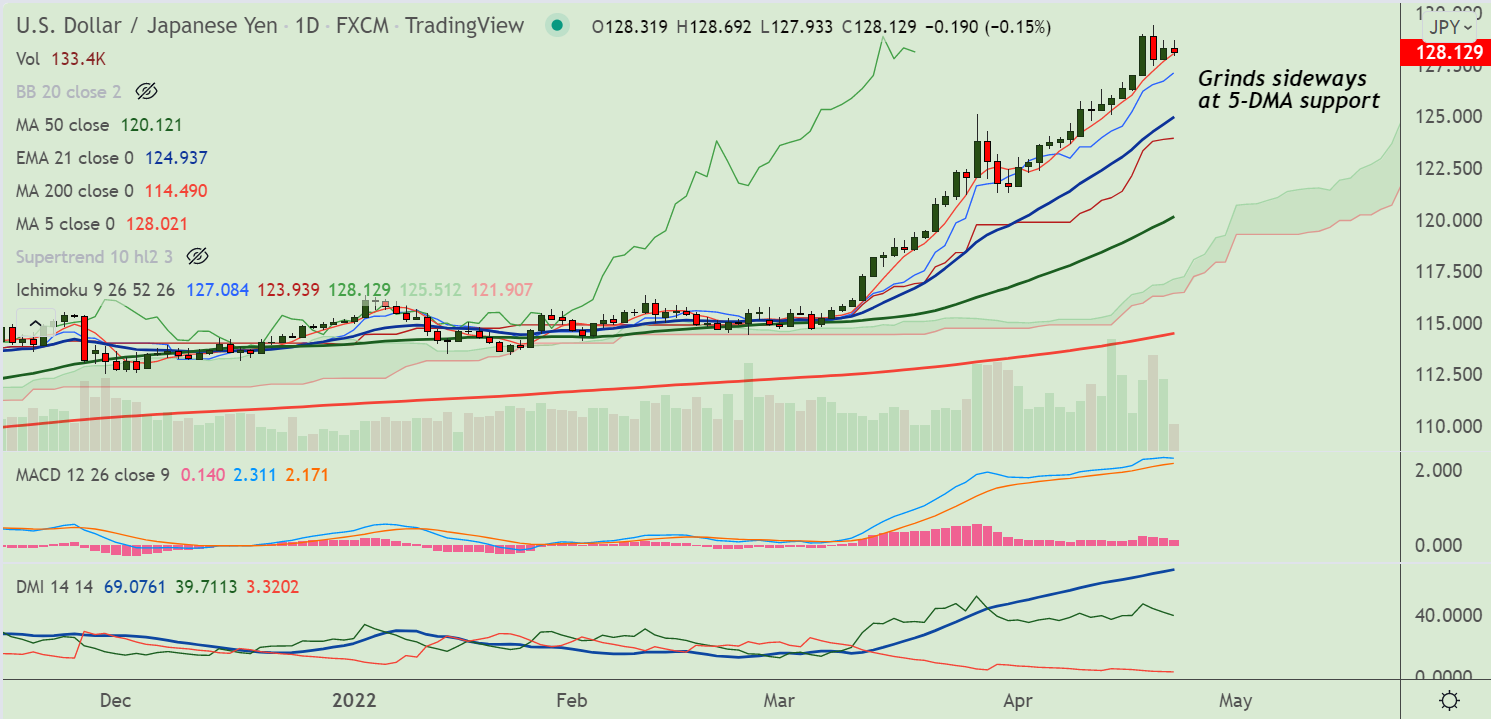

Chart - Courtesy Trading View

Technical Analysis: Bias Neutral

- USD/JPY was trading rangebound on the day with session high at 128.69 and low at 127.93

- The pair is extending sideways at 5-DMA support, intraday bias is neutral

- GMMA indicator shows major and minor trend are strongly bullish

- Volatility is high and momentum is bullish, oversold oscillators warrant some caution

Fundamental Overview:

The Japanese Yen catches a bid as Japan government mulls higher fuel aid, extra budget in relief package.

Prime Minister Fumio Kishida’s administration mulls another comprehensive relief package after laying out the outline of long-term economic and fiscal policy in June, reports Reuters

On the other side, Federal Reserve (Fed)’ chair Jerome Powell renewed fears of significant liquidity shrinkage from the economy, underpinned a 50 bps rate hike.

Major Support Levels:

S1: 128.02 (5-DMA)

S2: 126.88 (200H MA)

Major Resistance Levels:

R1: 129.33 (Upper BB)

R2: 130

Summary: USD/JPY likely to grind sideways. Potential for minor weakness on account of overbought oscillators. Major trend however, remains bullish.