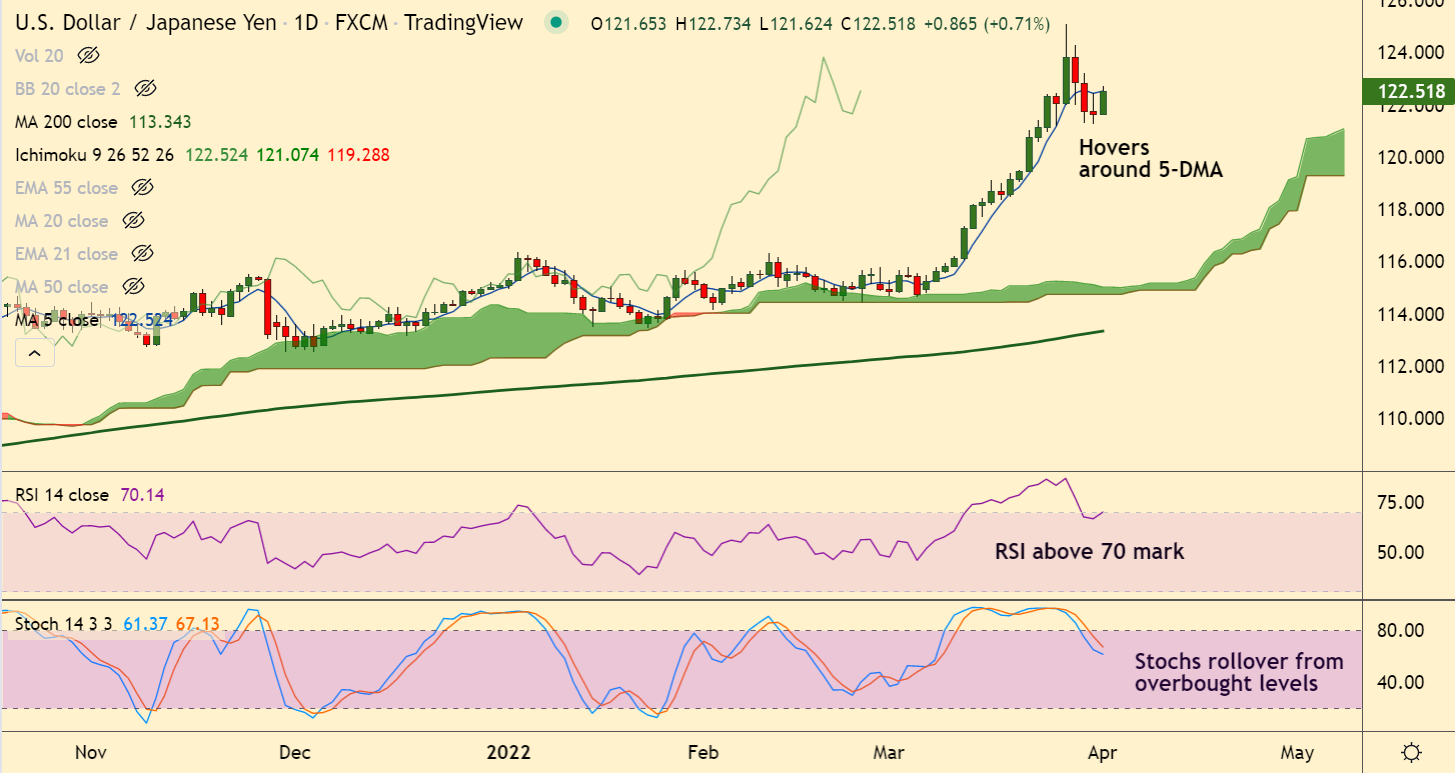

Chart - Courtesy Trading View

USD/JPY was trading 0.80% higher on the day at 122.63 at around 05:05 GMT.

The pair snapped a three day bearish streak and edged higher to retrace dip below 200H MA.

Rising odds of a 50 bps rate hike by the Fed are strengthening the US dollar across the board.

Further, the Bank of Japan (BOJ) comments which show fears over the rising commodity prices dent the yen.

BoJ noted that Japan, being a major importer of commodities is facing a serious threat of a wider fiscal deficit from elevated prices of base metals, food items, and energy amid Russia’s invasion of Ukraine.

Focus now on the key US Nonfarm Payrolls data for impetus. Uncertainty over the release of US Nonfarm Payrolls on Friday is improving the demand for the greenback.

Technical bias for the pair is bullish. Pullbacks on account of overbought conditions are likely to be shallow.