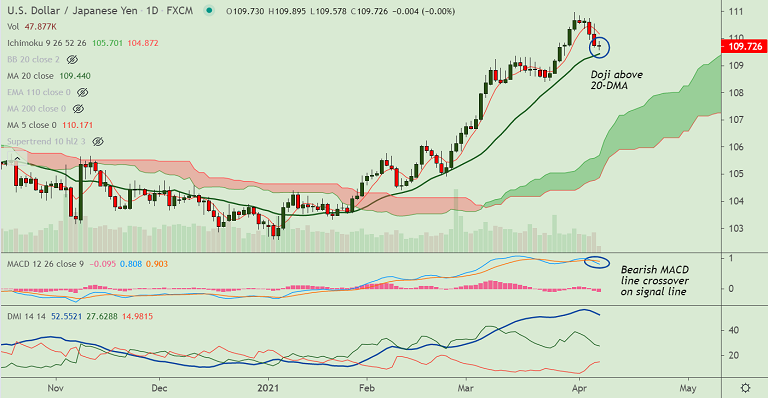

USD/JPY chart - Trading View

USD/JPY was trading largely unchanged at 109.76 at around 04:40 GMT, after closing 0.39% lower in the previous session.

Investors re-price Fed rate hike expectations, triggered by the recent series of encouraging US macro data.

This led to the sell-off in the Treasury yields across the curve, which accelerated profit-taking in the US dollar.

USD/JPY slumped lower for 2 straight sessions and price has now paused downside above 20-DMA.

All eyes remain on the FOMC minutes for any hints on the Fed’s take on the inflation outlook and the forward guidance.

US trade balance will also remain in focus and the pair will also remain at the mercy of the dynamics in the US Treasury yields.

Japanese Prime Minister Yoshihide Suga said that there remains a possibility of a snap election before the end of September.

Comments from the Japanese Prime Minister Yoshihide Suga weighs negatively on the yen, supporting USD/JPY higher.

Support levels - 109.44 (20-DMA), 109.27 (21-EMA), 108.97 (200W MA)

Resistance levels - 110.17 (5-DMA), 110.67 (88.6% Fib), 111

Summary: Bullish bias for the pair intact as long as price holds above 20-DMA support. Major trend is bullish, but violation at 20-DMA could change near-term dynamics.