- USD/JPY has edged higher from session lows at 110.00 and is currently trading at 110.17.

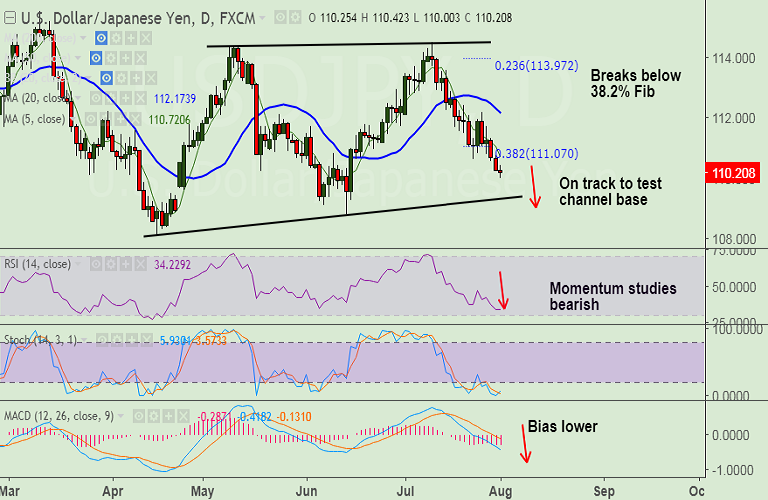

- Momentum studies are bearish on daily charts and we see scope for test of channel base at 109.30.

- Violation at channel base would open doors for a steeper slide towards 108.80 (June low).

- Price has broken below weekly 50-DMA at 110.42 and 38.2% Fib retrace of 98.787 to 118.662 rally at 111.07.

- Bearish invalidation only on decisive breakout above weekly 20-DMA at 111.25.

Support levels - 110, 109.30 (channel base), 109, 108.80 (June lows)

Resistance levels - 110.42 (weekly 50-SMA), 110.71 (5-DMA), 111.07 (38.2% Fib retrace of 98.787 to 118.662 rally)

Call update: Our previous call (http://www.econotimes.com/FxWirePro-USD-JPY-hits-fresh-6-week-lows-at-11030-geopolitical-tensions-keep-yen-buoyed-827929) has target 1.

Recommendation: Stay short for 109.30.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest.