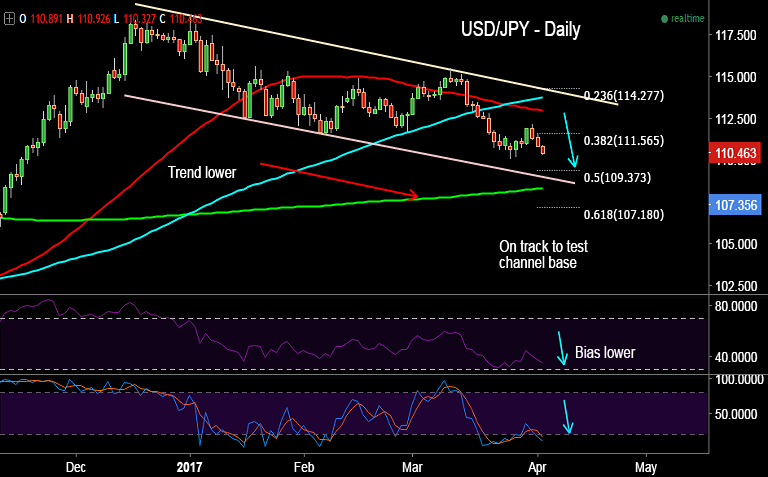

- USD/JPY is trading a falling channel, we see scope for test of channel base at 109 levels.

- Technical indicators are bearish, RSI and Stochs are biased lower.

- The Japanese yen was sold-off into BOJ Governor Kuroda’s dovish remarks, but recovery in the pair lacked momentum.

- BOJ governor Kuroda said it was too early to talk about exit strategy from current monetary policy, which includes ETF purchases.

- Unimpressive US manufacturing PMI data continues to keep the USD and treasury yields under pressure.

- USD/JPY finds next major support at 110.10 (March 27 low), break below targets 50% Fib retrace of 100.08 to 118.662 rally at 109.37.

Support levels - 110.10 (March 27 low), 109.37 (50% Fib retrace of 100.08 to 118.662 rally), 109 (channel base)

Resistance levels - 111, 111.14 (5-DMA), 111.56 (38.2% Fib), 112

TIME TREND INDEX OB/OS INDEX

1H Bearish Neutral

4H Bearish Neutral

1D Bearish Neutral

1W Bearish Neutral

Recommendation: Good to go short on rallies around 110.70/80, SL: 111.20, TP:

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at 113.433(Bullish), while Hourly JPY Spot Index was at 102.362 (Bullish) at 0340 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.