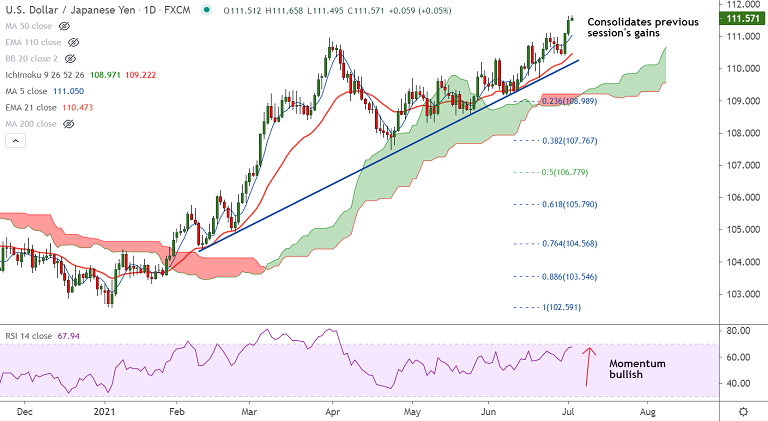

USD/JPY chart - Trading View

USD/JPY was holding marginal gains on the day and was trading at 111.56 at around 04:10 GMT, after closing 0.37% higher in the previous session.

The pair is witnessing cautious trade as markets await the crucial US Non-Farm Payrolls report which is an important catalyst for USD price action.

The ISM Manufacturing PMI decreased to 60.6 in June from 61.2 in May and below consensus at 61.00, according to data by the Institute for Supply Management released Thursday.

U.S. manufacturing activity grew robustly in June amid strong demand, but the growth pace lost some steam as supply-chain strains and labor shortages continued to weigh on production.

Details of the report showed the employment component dropped to 49.9 but the prices-paid sub-component jumped to the highest since 1979.

On the contrary, Initial claims for last week fell to 364K, dragging down the four-week average to 392.75K, which in turn backs a strong NFP print.

U.S. NFP is expected to rise from 559K to 690K in June. Markets expect US unemployment rate to drop from 5.8% to 5.6%.

Should the jobs report keep portraying strong recovery in the US labor conditions, the push for Fed’s monetary policy adjustments will be stronger and favor the USD bulls.

Further, the International Monetary Fund’s (IMF) comments suggest an upward revision to 2021 GDP and rate hike calls during the second half of 2022, along with the start of tapering in early 2022.

IMF's rate hike chatters support dollar bulls, however, the latest Delta covid variant outbreak will likely cap upside. Market’s indecision will challenge bulls.

Technical bias is strongly bullish. The major is on track to test monthly cloud top at 112.32. Breakout of monthly cloud will propel the pair higher.