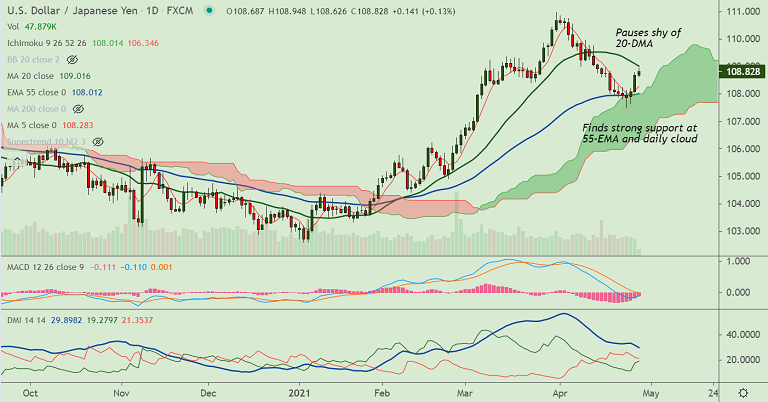

USD/JPY chart - Trading View

USD/JPY was extending marginal gains on the day, was trading 0.15% higher at 108.84 at around 05:00 GMT.

The major was extending gains for the 3rd straight session as the pair retraces from multi-week lows at 107.47.

Cautious trade continues ahead of the US Federal Reserve’s (Fed) monetary policy decision. Fed is unlikely to offer any hints of tapering while keeping the monetary policy unchanged.

Focus will however be on Powell’s statement to see how the chairperson defends the US central bank’s current policies.

On the other side, optimism surrounding US President Joe Biden’s stimulus measures favor the US dollar. DXY up 0.13% intraday around 91.00 at the time of writing.

Technical bias for the pair is turning bullish. Price action has edged above 21-EMA. RSI has edged above 50 mark and 5-DMA has turned.

The major is currently trading shy of 20-DMA resistance at 109.01. Watch for breakout above for upside continuation.