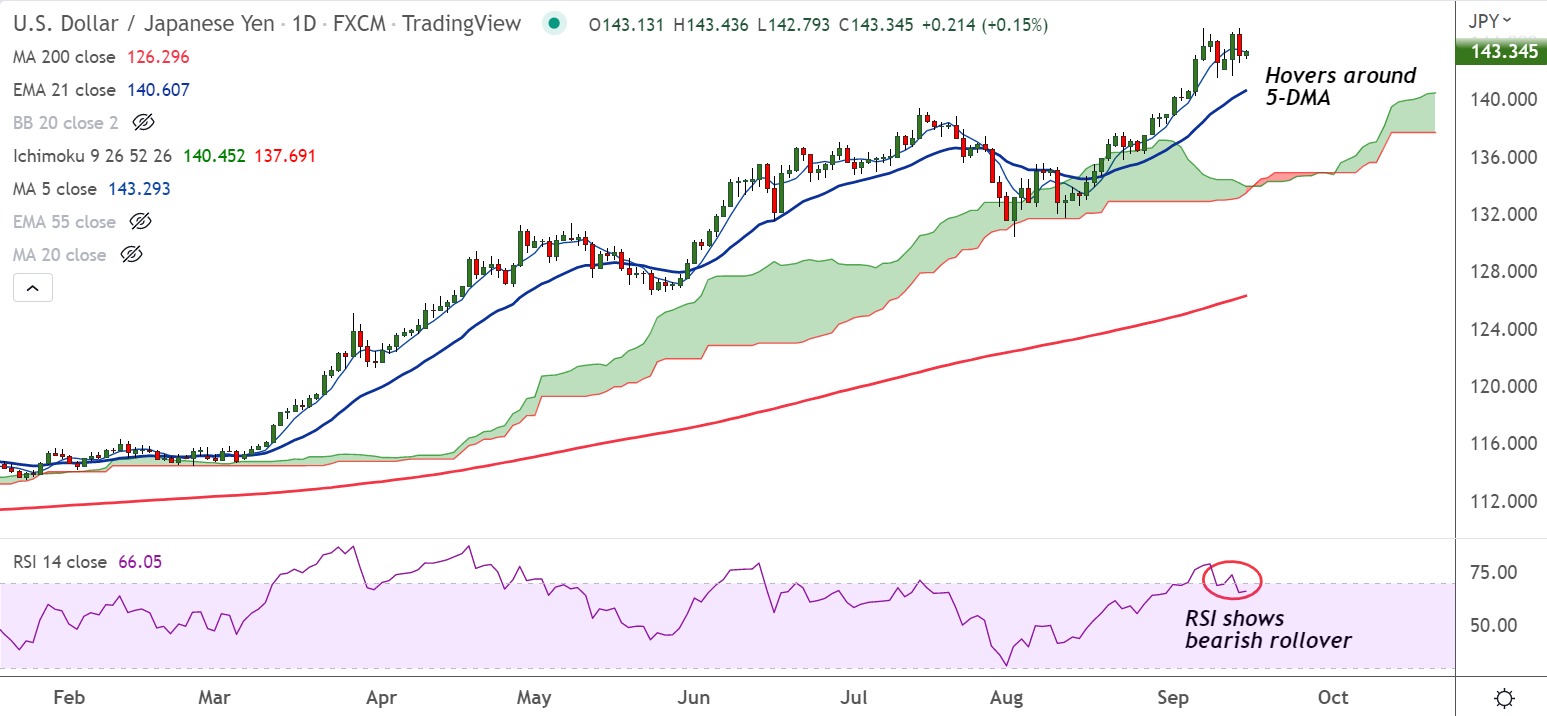

Chart - Courtesy Trading View

USD/JPY was trading 0.22% higher on the day at 143.45 at around 03:15, major bias remains bullish.

Data released overnight showed US Producer Price Index (PPI) declined to 8.7% YoY in August from 9.8% in July, versus 8.8% in market forecasts.

Details of the report showed Core PPI also eased to 7.3% YoY from 7.6% but surpassed the market expectation of 7.1%.

Favouring USD bulls are the 75% chance of the Fed’s 75 basis points (bps) rate hike in the next week, as well as the 25% odds favoring the full 100 bps lift, as per the CME’s FedWatch Tool.

Also, the Sino-American tussles and the energy crisis in Europe which challenge the market optimism keep USD bid.

Focus now on the US Retail Sales for August, expected to remain unchanged at 0.0%. Major attention will be on the Fed meeting next week.

Major Support Levels:

S1: 142.79 (200H MA)

S2: 140.61 (21-EMA)

Major Resistance Levels:

R1: 144

R2: 145.85 (Upper BB)

Summary: Techncial indicators for the pair show major trend is bullish. Price action is holding 200H MA support on the intraday charts. Break below will see minor weakness. Major weakness only below 21-EMA.