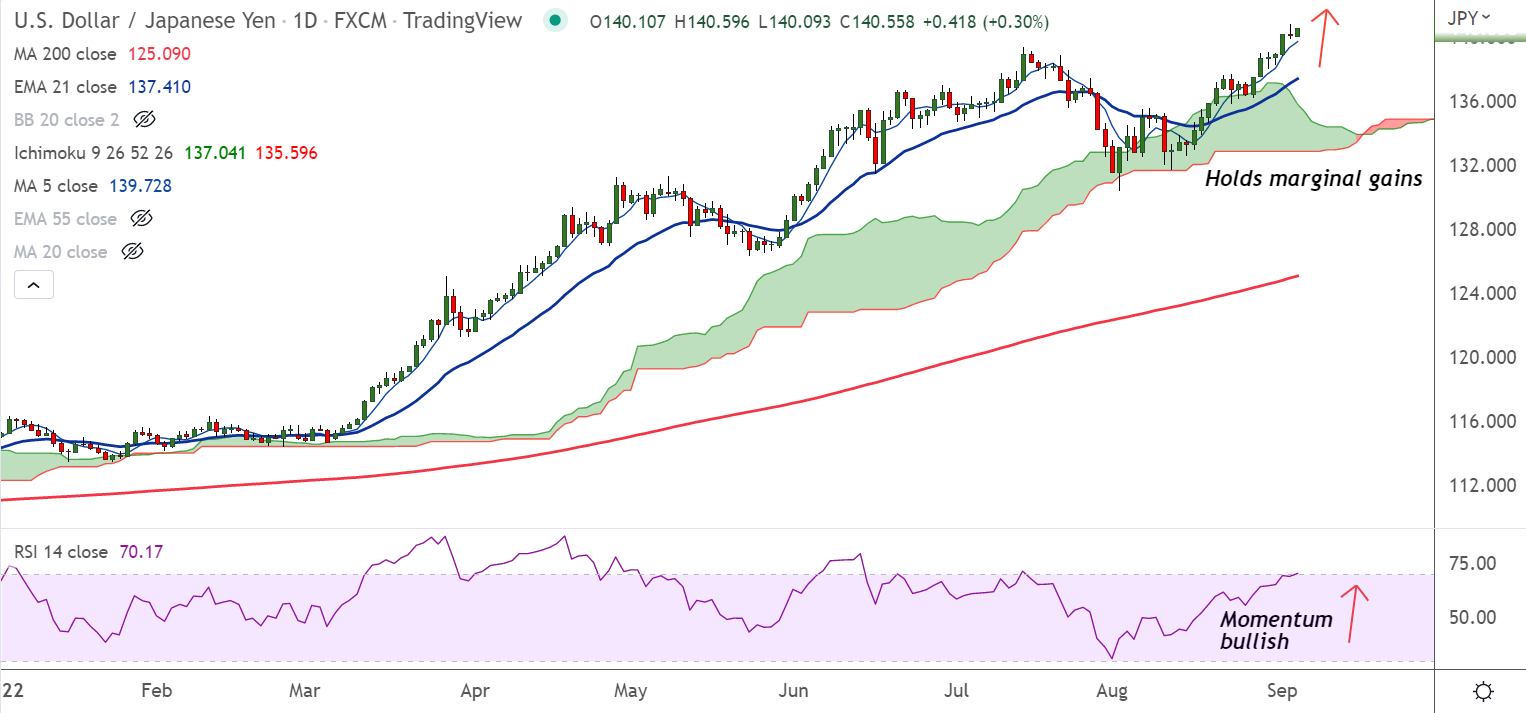

Chart - Courtesy Trading View

USD/JPY was trading 0.29% higher on the day at 140.54 at around 07:55 GMT.

The pair is holding marginal gains on the day, extending the current uptrend, bias remains bullish.

Upbeat US Nonfarm Payrolls (NFP) data on Friday last week, despite Fed warnings, keep the dollar supported.

The US economy created 315k jobs in August vs. the expectation of 300k and the prior release of 526k.

Focus now on the US ISM Services PMI data, due Tuesday, which is expected to decline to 54.9 against the prior release of 56.7.

Technical bias is bullish. Price action has bounced off daily cloud support. MACD and ADX support gains.

Volatility is high and rising and momentum is with the bulls. GMMA indicator shows major and minor trend are bullish

Major Support Levels:

S1: 139.72 (5-DMA)

S2: 138.40 (200H MA)

Major Resistance Levels:

R1: 141.43 (Upper BB)

R2: 142

Summary: USD/JPY trades with a bullish bias. Scope for further upside, weakness only below daily cloud.