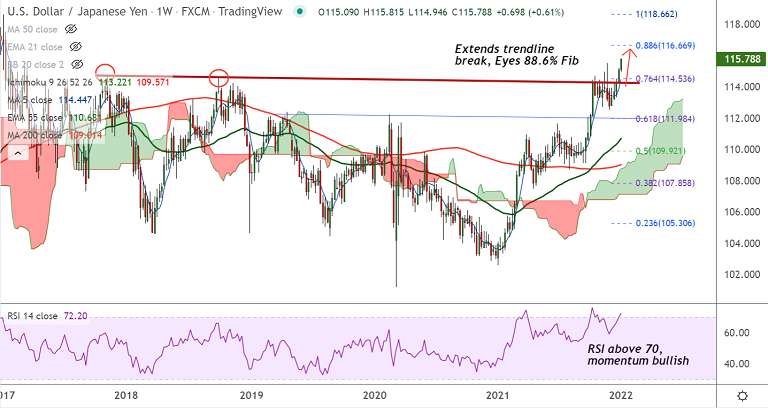

Chart - Courtesy Trading View

Technical Analysis: Bias Bullish

GMMA Indicator

- Major and minor trend are strongly bullish

Ichimoku Analysis

- Price action is well above daily cloud, pullback has held cloud support

- Chikou span is biased higher, scope for further upside

Oscillators

- Stochs and RSI are sharply higher, momentum is bullish

- Oscillators are at overbought levels, but no sign of reversal seen

Bollinger Bands

- Bollinger bands are spread wide apart

- Volatility is high and rising

Major Support Levels: 115.23 (5-DMA), 115, 114.53 (76.4% Fib)

Major Resistance Levels: 116, 116.66 (88.6% Fib), 117

Summary: USD/JPY is extending bullish streak for the 5th consecutive session. The pair has hit new 6-year high and is on track for further gains. Next major bull target lies at 88.6% Fib at 116.66.