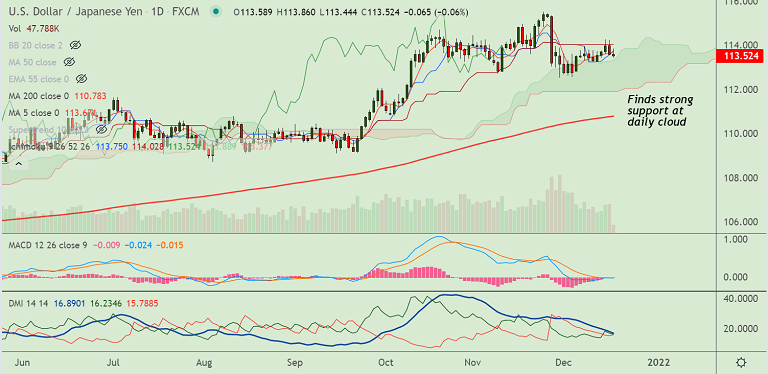

Chart - Courtesy Trading View

The Bank of Japan (BOJ) left its policy settings unadjusted at -0.1% once again but decided to scale back pandemic stimulus upon reaching March 2022 deadline.

USD/JPY remained largely unfazed after the meeting as markets had priced in the Japanese central bank to dial back emergency pandemic funding.

In its monetary policy statement the central bank said that it will end the increased purchases of corporate bonds, commercial paper in March 2022.

The BoJ added that it will be ready to take additional easing steps as needed with eye on pandemic impact on economy.

The greenback was sold-off the prior day due to technical reasons and the major is extending previous session's downside on Friday.

That said, with markets now expecting a faster pace to lift-off, downside in the pair is likely to be limited.

USD/JPY was trading 0.06% lower on the day at 113.52 at around 05:30 GMT. The major finds strong support at daily cloud. Further weakness only on break below.