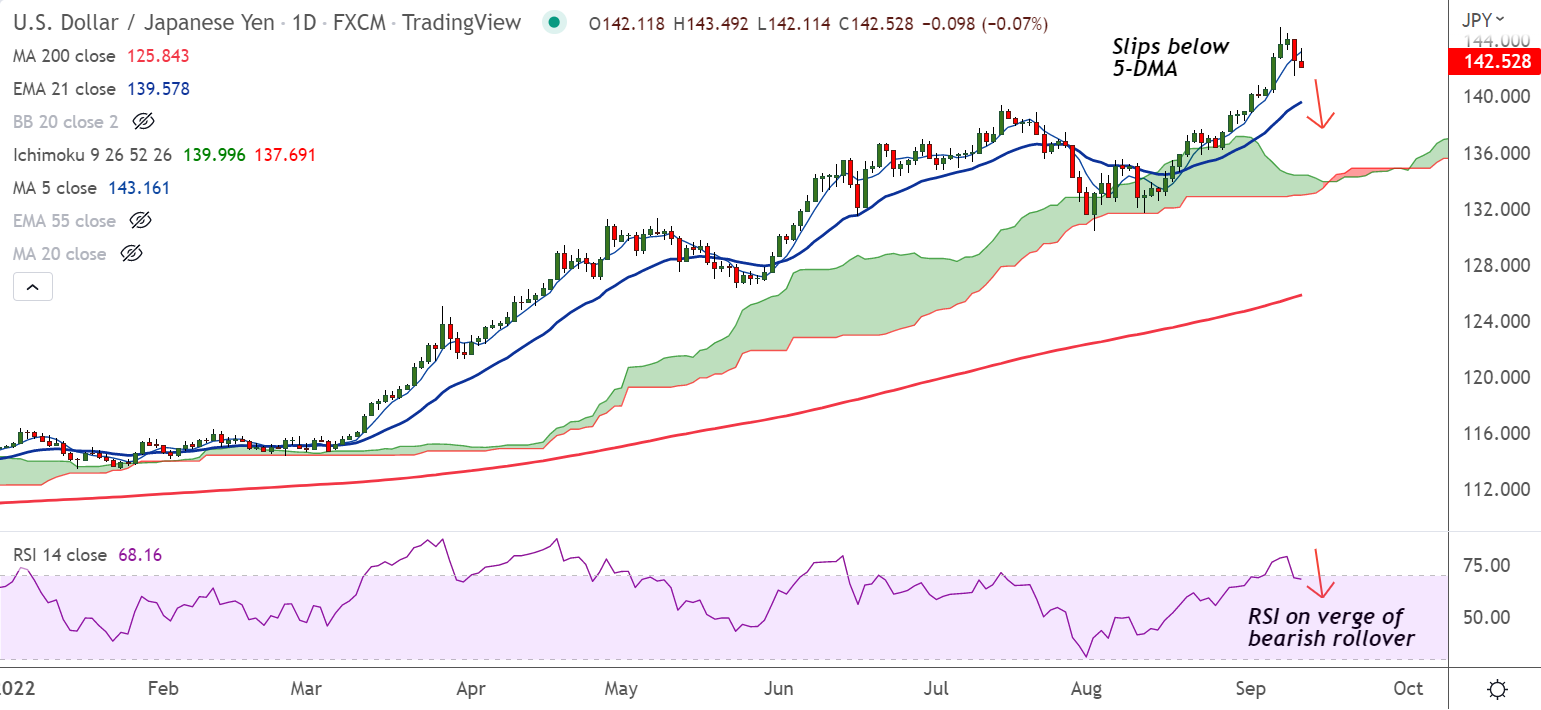

Chart - Courtesy Trading View

USD/JPY was trading 0.11% lower on the day at 142.46 at around 11:55 GMT, slips lower from session highs at 143.59.

Lower consensus for US Consumer Price Index (CPI) data, due Tuesday and speculation about BoJ intervention to arrest yen freefall is weighing on the pair.

Japanese Deputy Chief Cabinet Secretary Seiji Kihara urged the government to take necessary steps to counter excessive declines in the yen.

On the data front, US headline CPI is seen at 8.1%, lower than the prior release of 8.5%. While the core CPI is expected to rise by 10 basis points (bps) to 6%.

A decline in the price could scale down the Fed's hawkish tone, the central bank may likely dictate a subtle rate hike.

Markets have priced in a 75 bps rate hike move at the next FOMC meeting on September 20-21. And CPI data will play a key role in influencing the Fed's policy outlook and thereby the dollar's price action.

Technical bias for the pair is still bullish, but retrace below 200H MA could see some weakness. Major weakness only below 21-EMA.