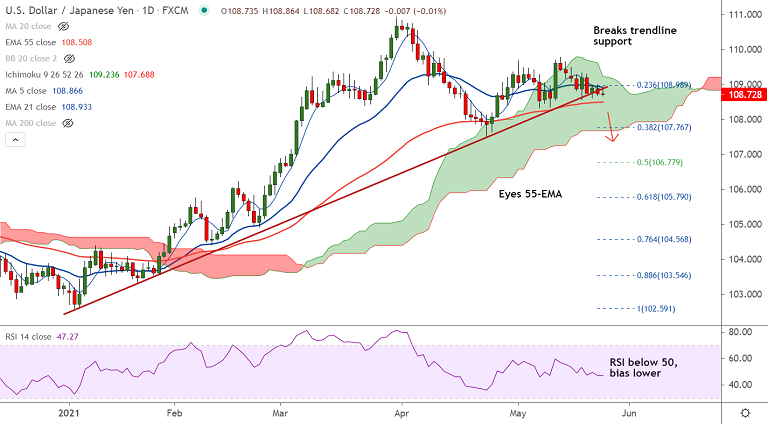

USD/JPY chart - Trading View

USD/JPY has erased early gains and was trading largely unchanged on the day at 108.72 at around 03:55 GMT.

US dollar resumes the downside amid the upbeat market mood and as Fed officials downplay inflation fears, further weakness on charts.

Upside remains capped below 109 handle, the pair is on track to test 55-EMA at a108.50. Break below to see further downside.

Price action has slipped below 200H MA. GMMA indicator has turned bearish on the intraday charts.

Oscillators are biased lower. Stochs and RSI are sharply lower and RSI is well below the 50 mark.

On the data front, U.S. building permits, redbook, monthly home price, consumer confidence, new home sales, Richmond Fed's manufacturing index in focus for impetus.

Upside remains capped below 21-EMA. Break below 55-EMA will see dip till 38.2% Fib at 107.76. Break below cloud will open downside.