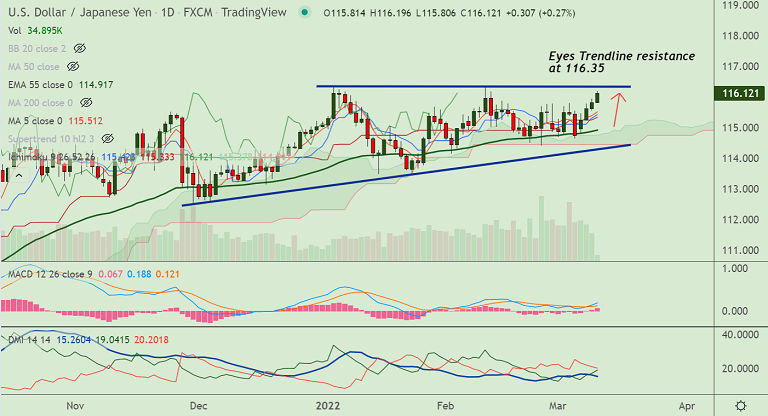

Chart - Courtesy Trading View

Spot Analysis:

USD/JPY was trading 0.06% higher on the day at 115.87 at around 08:30 GMT

Previous Week's High/ Low: 115.80/ 114.64

Previous Session's High/ Low: 115.94/ 115.55

Fundamental Overview:

Hopes for a diplomatic solution to Ukraine-Russia war remained supportive of the risk-on mood, undermining the safe-haven US dollar.

On the data front, Japan’s Producer Price Index (PPI) for February printed at 9.3% YoY, versus 8.7% expected and 8.6% prior.

Focus now on US CPI for a fresh impetus. US Consumer Price Index (CPI) for February is expected to rise to 7.9% from 7.5% prior.

Technical Analysis:

- GMMA indicator shows major and minor trend are bullish

- Stochs and RSI are sharply higher, momentum is with the bulls

- Price action is above daily cloud and Chikou span is biased higher

- MACD supports upside in the pair

Major Support and Resistance Levels:

Support - 115.39 (200H MA), Resistance - 116.35 (Wedge top)

Summary: USD/JPY poised for further gains. Eyes wedge top resistance at 116.35. Bullish invalidation below 200H MA.