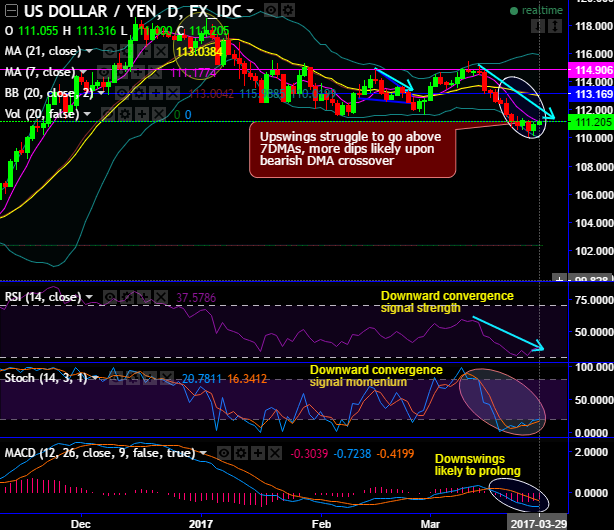

The current price behavior of this pair has been sliding through falling wedge formation (refer daily chart).

The current upswings struggle to go above 7DMAs, more dips likely upon bearish DMA crossover

Ever since long legged doji occurred on monthly charts, the momentum in major trend is intensified to evidence more slumps, as a result, the current prices have gone below EMAs on the weekly chart.

Current prices attempting to bounce back but well below EMAs, don't expect sharp rises as momentum now seems to be shrinking and most likely EMA crossover.

USDJPY dropped vigorously from the highs of 118.665 levels to the current 112.865 levels, the flurry of bearish streaks occurred especially after long legged doji at 116.942 levels in the uptrend that indicates weakness in this pair.

RSI signals gaining strength in selling sentiments as it converges to the mild sideways to downswings on both daily and a clear convergence to the slumps on weekly terms, while stochastic has been indecisive but the momentum in selling sentiments is biased to bears.

Most importantly, MACD has signaled the downtrend likely to extend on both timeframes.

Trading tips:

Well, as a result of above technical reasoning, on speculative grounds we advise tunnel spreads which are binary versions of the debit put spreads.

This strategy is likely to fetch leveraged yields than spot FX and certain yields keeping upper strikes at 111.534 and lower strikes at 111 levels.