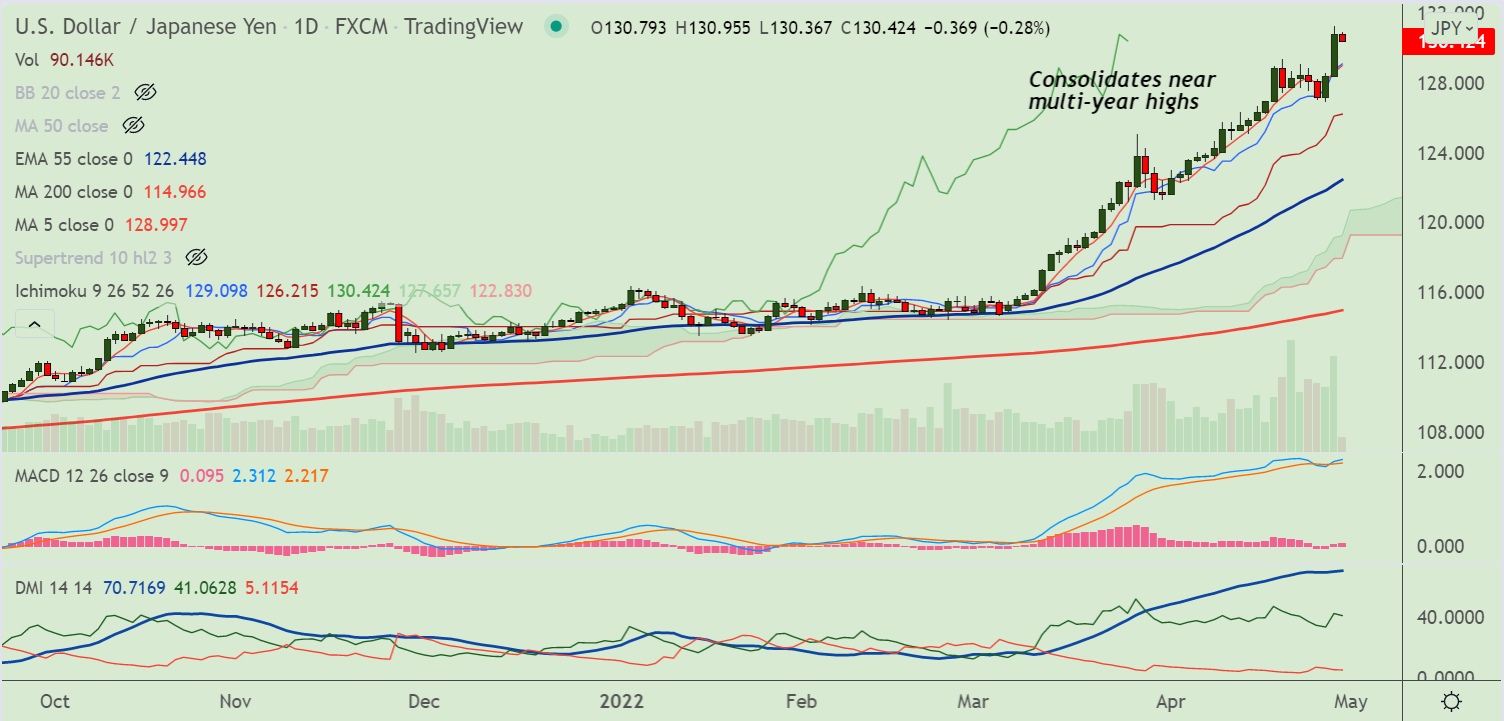

Chart - Courtesy Trading View

USD/JPY was trading 0.16% lower on the day at 130.58 at around 04:20 GMT.

The pair closed a whopping 1.85% higher in the previous session and is on track to close over 7% higher for the month.

The Japanese yen battered on Thursday after an extremely dovish BoJ, boosting upside in the pair.

The Bank of Japan (BOJ) on Thursday showed readiness for unlimited bond-buying to maintain the yield target.

The central bank cited sustained inflation below the 2.0% target and its economic forecasts lacked optimism, further weighing on the pair.

Russia-Ukraine crisis join China’s covid concerns to weigh on the risk appetite and support the US dollar’s safe-haven demand.

Focus now on US Core Personal Consumption Expenditures Price Index for March, expected to ease to 5.3% YoY from 5.4% in the previous month.

Major Support Levels:

S1: 128.99 (5-DMA)

S2: 128.49 (200H MA

Major Resistance Levels:

R1: 131.10 (Upper BB)

R2: 132

Summary: USD/JPY trades with a bullish bias. Pullbacks if any on account of overbought conditions are likely to be shallow. Scope for test of 135 levels.