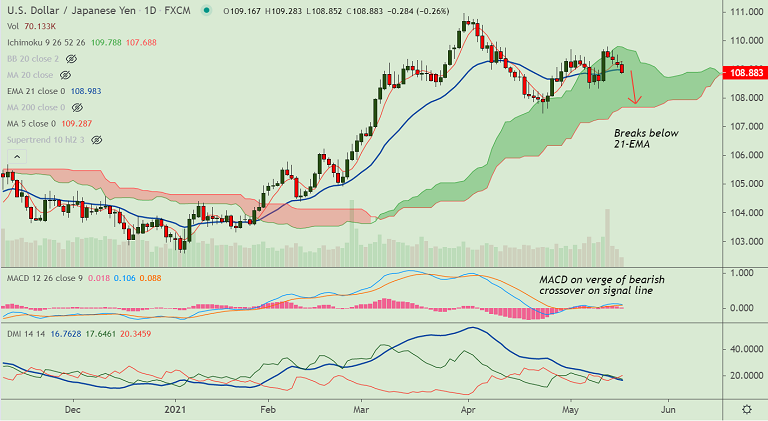

USD/JPY chart - Trading View

USD/JPY was extending downside for the 4th consecutive session, breaks below 21-EMA.

The major was trading 0.23% lower on the day at 108.92, upside remains capped below 5-DMA.

The US dollar remained depressed amid expectations that the Fed will keep rates low for a longer period.

Further, the US dollar index (DXY) remains depressed below 90 and the 10-year Treasury yield gains 1.5 basis points (bps) to 1.65% at the time of writing.

Technical indicators are turning bearish. RSI has slipped below 50 mark. Stochs are showing a rollover from overbought levels.

MACD is on verge of bearish crossover on signal line. Price action has slipped below 200H MA.

GMMA indicator shows bearish shift on the intraday charts. However, major trend on the daily charts remains bullish.

Clarity over reflation and the Fed’s next moves to provide fresh impulse. Focus remains on Wednesday’s Federal Open Market Committee (FOMC) minutes for cues.

20-DMA is offering immediate support at 108.82. Break below will see dip till 108.60 (trendline) ahead of 55-EMA at 108.43.