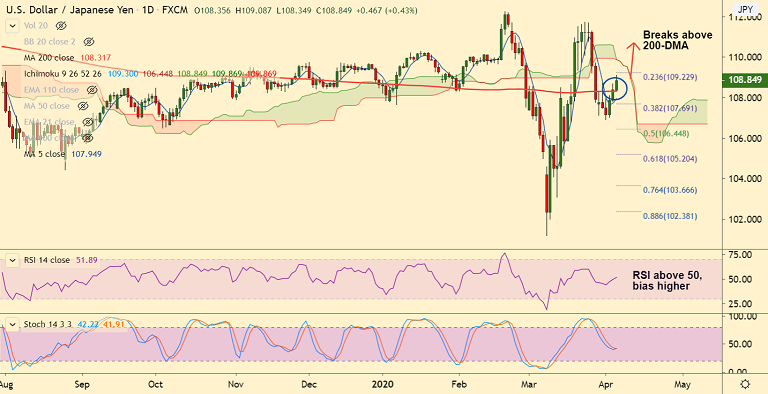

USD/JPY chart - Trading View

The Japanese yen remains on the back-foot amid a likely state of emergency in Japan as COVID-19 cases spike.

USD/JPY rises 0.53% on the day to briefly flirt with 109.00 handle, erases some gains to trade at around 108.85 at 04:05 GMT.

The Japanese government is set to announce a state of emergency on April 7, Tuesday, which will take effect on April 8, Wednesday.

The Japanese yen has been sold-off across the board amid expectations of a rescue package to be rolled out soon.

On the other side, risk-on fostered by reports of a slowdown in the number of coronavirus cases in some of the worst-hit countries like the US, Italy, and Spain keeps the greenback supported.

Major trend in the pair is neutral, but minor trend is showing some signs of bullishness. Close above 200-DMA will fuel further gains.

Next major resistance aligns at 109.79 (daily cloud), break above to see retest of March highs at 111.71.

Major Support Levels: 108.31 (200-DMA), 107.95 (5-DMA)

Major Resistance Levels: 109.30 (Tenkan sen), 109.79 (Daily cloud)

Guidance: Stay long on close above 200-DMA, SL: 107.90, TP: 109.30/ 109.75

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand