The strong US dollar depreciation seen since mid-December seems to have been stopped for now and most recently the US currency was able to regain some lost ground again. There is only one currency in the G10 universe that did considerably well since early February and that is the Japanese yen. JPY’s outperformance for the past two weeks has been remarkable: JPY appreciated to the highest level in 5 months in nominal weighted terms.

If at all USDJPY is projected to slide towards 100 on following driving forces, the below options strategy is advocated on hedging grounds.

The factors that likely to drive further USDJPY weakness:

1) The global investors’ risk aversion heightens significantly,

2) The weak US economy dampens hopes for Fed hikes and leads broad USD weakness, and

3) The expectations for more hawkish than expected personnel change of the BoJ heighten.

Options trades recommendations:

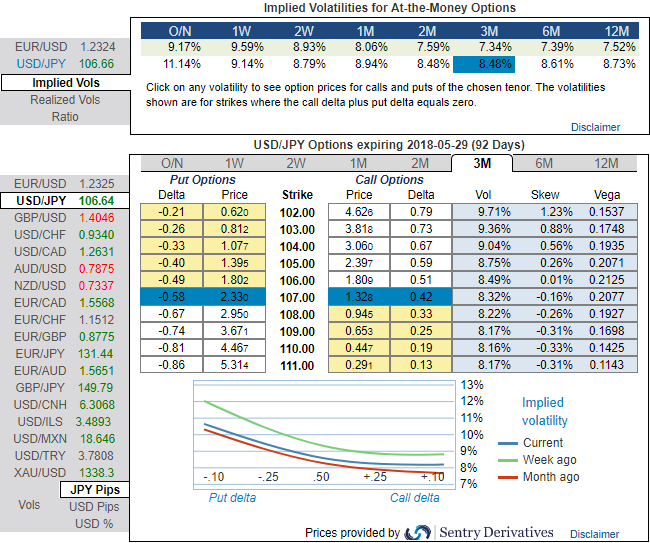

The implied volatility of ATM contracts of USDJPY is trading at around 8.94-8.48% for 1-3m tenors, as the positively skewed IVs of 3m tenors signify the hedging sentiments for the further downside risks over the period of time, this appears to be conducive for put option holders.

Thus, we advocate buying USDJPY 1y put spread strikes 106/103, global knock-in 116 Indicative offer: 0.33% (vanilla: 0.75%, spot ref: 106.662).

Investors trading a put spread with a global knock-in cannot lose more than the premium initially paid. However, the structure will be activated only if USDJPY hits the 116 knock-in. Otherwise, it will expire worthless even if USDJPY trades below 106 one year ahead.

Currency Strength Index: FxWirePro's hourly USD spot index has shown -77 (which is bearish), while hourly JPY spot index was at 12 (neutral) while articulating at 09:02 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts