We add short EM vol risk on positive developments this week, tactical yen bearishness plays well alongside good-quality carry. So, we’ve have turned tactically bearish on the yen, expecting USDJPY to edge northwards at 114 in the weeks to come with French elections behind us and Treasury yields anticipated to rise somewhat in the run-up to the June FOMC from current benign levels (Fed funds strip priced for only one hike this year, while a few analysts expect two) alongside firming 2Q US growth to 3% SAAR.

Bearishness on the JPY can be allied to mainstream constructive views on other currencies (EUR and SEK for instance) or more traditional carry candidates (BRL, INR etc.) to generate additional leverage in multi-currency option structures.

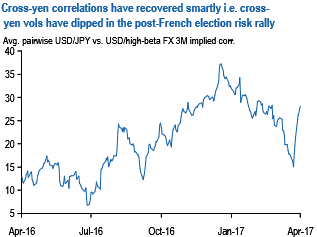

As a class of trades, these have become more tenable as cross-yen correlations have rebounded smartly since the French elections (refer above chart); indeed, we had flagged high-beta yen-crosses to be the best value candidates for a post-French election risk rally.

The above chart runs us through dual digital prices across a select universe of currency combinations, and finds that [USD/EM lower, USDJPY higher] dual digitals are well-priced in the likes of INR and BRL.

2M [USDINR < 0.5% OTMS, USDJPY > 0.5% OTMS] dual digitals are indicatively offered @ 8.5% / 14.75% USD indicative offer.

2M [USDBRL < 0.5% OTMS, USDJPY > 0.5% OTMS] dual digitals are indicatively offered @ 12.5% / 16.5% USD indicative offer.

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes