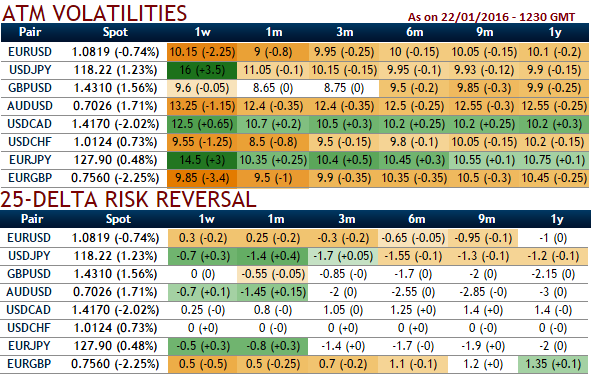

We can figure out the neutral delta risk reversals for GBPUSD and USDCHF for 1w expiries with sluggish implied volatilities. While conducting technical analysis also we found narrow range trend for USDCHF but slightly bullish biased in short run.

Lock in the certain revenues that are proportionate with the yields available spot FX, consequently maximize the revenues of the portfolio as this strategy to focus on non-volatile advantages.

In such lower IVs and non-directional scenarios, with spot FX at 1.0144 a foreign trader shorts straddle when he sells both puts and calls on the same spot FX levels with identical strikes and expiries. This is meant to be a means of profits he is certain about stable spot FX movements in within the expiries what he has chosen.

But a seller wants IV to fall so the premium falls. You should also note short-dated options are less sensitive to IV, while long-dated are more sensitive.

This is instinctive owing to the higher probability of the market 'swinging' in range bounded trend.

Well, for this strategy to be covered, he also owns spot FX positions to fulfill the obligations on calls and essential cash to buy back the puts he has sold. Thus, the writer of straddle is always subject to risk of exercising the options rights. However, the probabilities of being assigned these risks are minute on both the legs.

Although, he collects the cash on both calls and puts writings in the form of initial premiums but he has obliged to make o take delivery of spot USDCHF in rare scenarios at the strike price.

FxWirePro: USD/CHF writers on upper hand in lower IVs - shorting covered straddle eyes on neutral risk reversals and assures certain yields

Monday, January 25, 2016 9:01 AM UTC

Editor's Picks

- Market Data

Most Popular

9