USDCHF has tumbled to remain in the range which was anticipated by FxWirePro.

Technically, the pair has shown more bearish traction and we’ve accordingly, advocated short hedging vehicle.

If you could observe the quantum of slumps in the underlying spot FX, you could very well imagine how much this short hedge would have mitigated the bearish risks (constantly, tumbled from the highs of 1.0355 to the recent lows 0.9525 levels).

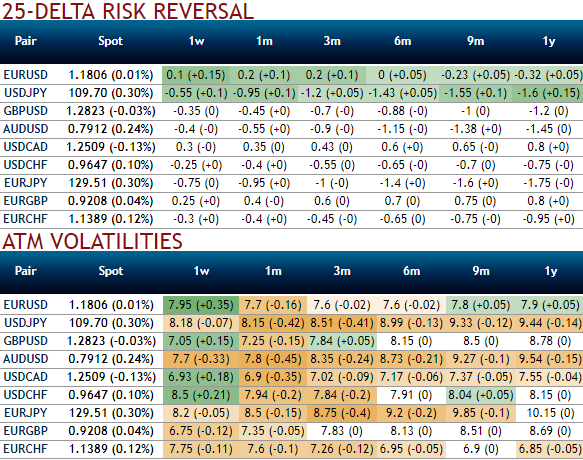

Please be noted that the ATM implied volatilities are shrinking away (3rd least among the lot), faded below 8% for 1-3m tenors.

The 1M IV skews signify the importance of OTM put strikes in OTC FX markets.

Well, for now, the question is would it turn around from this levels or sell-off in USDCHF was too little, too late for our put spread that expired OTM.

While risk reversals across all tenors have been bearish neutral which is moving in sync with positively skewed IVs and spot FX movements.

25-delta risk reversals evidence no disparity in volatility and prices, between puts and calls on the most liquid out of the money (OTM) options quoted on the OTC market.

USD put/CHF call flies can be rationalized on similar grounds: there isn’t much skew advantage to selling OTM CHF calls although they have normalized a tad as option-buying interest has picked up recently, but their short vega exposure helps defray part of the negative interest rate carry cost and call flies, on the whole, have become more reasonably priced of late (refer above nutshell).

Our preference is for RKI flies (RKI on the middle leg) where the trade-off of a few more bps in option premium for materially extended participation in the spot downtrend is an acceptable one. 2M 0.9770 – 0.9540 with 0.9435 RKI at spot reference 0.9544, max payout ratio 4.7 times if RKI triggers.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary