- USD/CAD has recovered sharply after a weaker than expected Canadian economic data. The pair hits tow week low after dovish FOMC minutes meeting and strong crude oil prices. The pair declined till 1.26728 after Fed minutes showed concerns over weak inflation .The rate hike in Dec is confirmed but there are growing doubts over three more hikes in 2018. US dollar index broken major support at 93.40 (50- day MA) and dipped till 93.10 at the time of writing.

- Canadian retail sales came at 0.1% compared to forecast of 1.0%. Retail sales is declining for the past four months after a massive jump in the month June. Economists are forecasting third quarter of 1.8% annualized down from 4.5% in the second quarter.

- Crude oil prices hit 2-1/2 high on keystone pipe line shutdown. Oil prices has broken major resistance of $57.89 and jumped till $58.67. It is currently trading around $58.53.

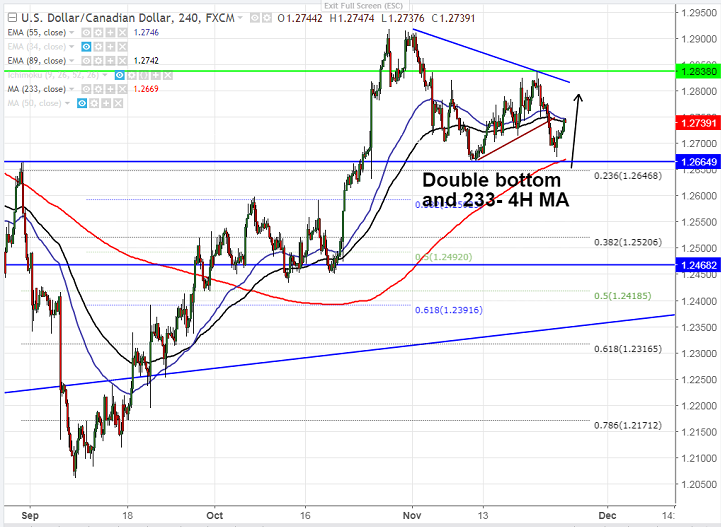

- The pair has formed a minor bottom at 1.26728 and shown a minor jump. Short term trend is bullish as long as support 1.26500 holds. Any break below will drag the pair to next level till 1.2600/1.2500. It should break below 1.24300 for overall bearishness.

- On the higher side, near term resistance is around 1.2750 and any violation above will take the pair to next level till 1.2800/1.28365. Short term bullishness can be seen only above 1.2835.

It is good to buy on dips around 1.2705 with SL around 1.2650 for the TP of 1.2800/1.2835.