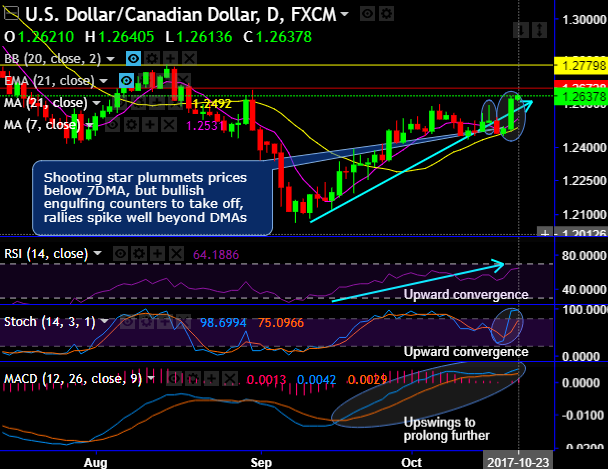

Shooting star plummets prices below 7DMA, but bullish engulfing counters to take off, rallies spike well beyond DMAs.

On a broader perspective, 3-black crows pattern occurred on monthly terms and breaches below channel support & 38.2% Fibonacci levels but the dragonfly doji counters to hover back at 38.2%. As a result, the pair that was in corrective mode even after retracing 38.2% Fibonacci levels has occurred at 1.2464 levels, amid this journey the bearish swings have traveled equidistant areas on monthly terms.

But for now, USDCAD bulls resume from last month ever since the formation of the bullish pattern (dragonfly doji), it is currently bouncing back to 2-months’ highs at 1.2641levels.

We foresee more rallies as the breach above a stiff resistance of 1.2600 and jump till 1.26290 on both daily and monthly charts has been stimulating bullish sentiments. This is coupled with weak Canadian economic data. Canadian retail sales numbers missed the consensus, dropped by 0.7% MoM in Aug which is well below the forecast of 0.3% increase and core CPI came in at 0.2% MoM below expectations of 0.3%. The weak data will stop the further increase of interest rate by BOC. The policy divergence between BOC and US Fed will take the USDCAD to next level till 1.2675/1.28 mark.

While RSI and stochastic curves on both timeframes signal overbought pressures as the leading oscillators evidence the upward convergence constantly along with the price spikes.

Ever since USDCAD has shown failure swings at 1.3793 levels, the prices have tumbled below EMAs. That’s where the three-black crows candle pattern is traced out, but for now, we see more chances spikes upto 7EMAs (i.e. where next strong resistance is seen at 1.2750, refer monthly plotting).

To substantiate these bullish stances, MACD also indicates upswings to prolong further by evidencing bullish crossover in the bullish trajectory.

Trade tips:

Well, contemplating above technical reasoning, on speculative grounds, at spot reference around 1.2640 levels, we advise bidding for one-touch binary call options.

This leveraged instrument is likely to fetch magnified yields than spot FX as long as underlying spot keeps spiking.

Currency Strength Index: FxWirePro's hourly USD spot index is flashing positive 97 (which is bullish), while hourly CAD spot index was at a tad below -15 (mildly bearish) at 12:35 GMT. For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit: