- US oil is extending retrace from multi-year highs above $75, slips below $72 levels.

- As of writing, the barrel of West Texas Intermediate was trading at $73.00, losing 0.18%, on the day.

- An unexpected build in the U.S. commercial crude inventory prompted profit-taking dragging prices lower overnight.

- According to the US Energy Information Administration, US crude stocks rose by an unexpected 1.3 million barrels last week.

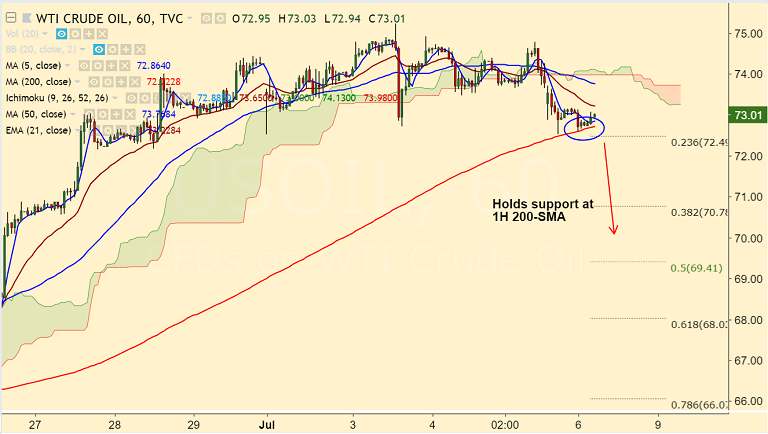

- Price has broken below 5-DMA and is currently holding support at 1H 200-SMA at 72.72.

- Decisive break below 1H 200-SMA will fuel some bearish bias. Dip till 21-EMA at 70.58 then looks likely.

- On the upside, bullish continuation likely only on decisive break above major trendline resistance at 75.40.

Recommendation: Watch out for break below 1H 200-SMA to go short. Target 71/ 70.80/ 70.60

FxWirePro Currency Strength Index: FxWirePro's Hourly USD Spot Index was at -56.9675 (Neutral) at 0515 GMT. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.