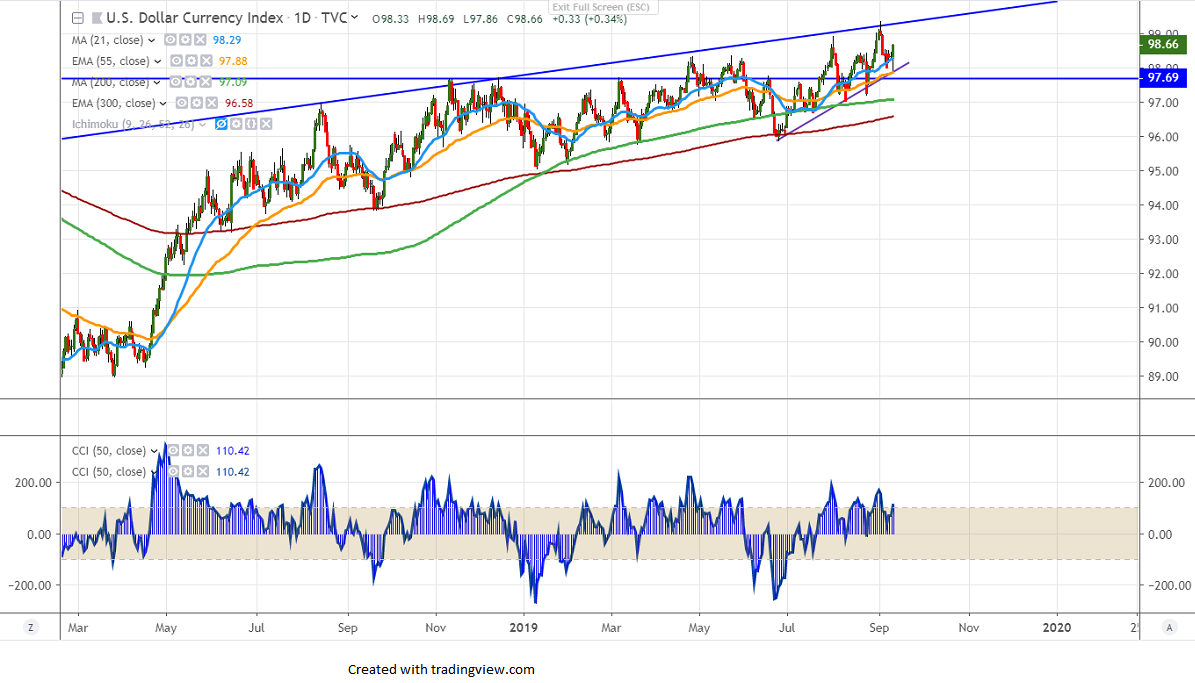

Major support- 97.80

US dollar index has taken support near 55- day EMA and jumped more than 80 pips on broad-based US dollar buying. According to the CME Fed watch monitor tool, the chance of 25 bps rate cut decreased to 88.8% from 89.2% a week ago and the probability of keeping rates on hold jumped to 11.2% from 0%. It hits an intraday high of 98.68 and is currently trading around 98.68.

The near term resistance is around 99 and any break above will take the index to high 99.35 made on Sep 3rd, 2019. The bullish continuation can be seen only above 99.35.

On the flip side, near term support is around 98.21 (21- day MA) and any break below will drag the DXY to level 97.83/97. Major weakness only below 97 levels.

It is good to buy on dips around 98.35-40 with SL around 97.80 for the TP of 99.40.