January’s manufacturing PMI dipped to 55.9 from 56.1 in December, exactly in line with both our and consensus expectations. Despite the mild dip, the headline balance remains well above its historic average of 51.6 and the average over 2016 Q4 of 54.8.

The details of the report show that both export and domestic orders continue to expand, although the strength of exports seems particularly underwhelming despite the 12% post-referendum drop in sterling’s effective exchange rate. In fact, the export orders balance fell to 50.9 – barely above its historic average – from 55.6 last month. Currency weakness meanwhile continues to feed through to costs. The input price balance rose to 88.3, the highest on record, with prices charged also accelerating to 63.7, again one of the highest-ever readings.

Taken at face value, the elevated level of the PMI suggests that the contribution of manufacturing to UK GDP growth in 2017 is likely to be more positive than in recent months, despite the divergence of official estimates and surveys of activity since the referendum. That message is reinforced by the future expectations balance newly introduced in this release, which at 72.5 is at an 8-month high and well above the 50 no-change mark.

As the manufacturing sector accounts for only around 10% of UK economic activity, the UK’s growth outlook will nevertheless be primarily driven by the dominant services sector.

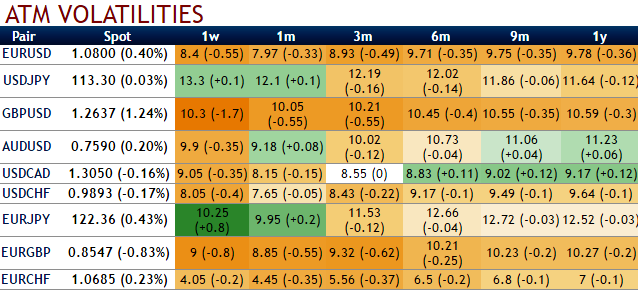

Please be noted that the reducing IVs for GBPUSD and EURGBP despite the flurry of significant economic news:

Fed’s funds rate which is likely to be announced shortly, the services PMI for UK due on Friday – coming after the Bank of England’s policy decision on Thursday, but with a preview seen by the MPC – is still expected to be at a level consistent with little slowdown from the 0.6% q/q GDP growth pace estimated for 2016 Q4. Whether service sector growth remains robust in the course of 2017 is a key issue for this year: the drag of rising prices on consumer purchasing power will be a key area to watch.

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist