The UK Inflation surprised on the downside for the second month in a row in March disappointed by missing the consensus. The annual rate of ‘headline’ CPI inflation dipped to 2.5% from 2.7% in February. This was below the consensus expectation that inflation would hold steady at 2.7% and was the third fall in the last four months following last November’s peak of 3.1%.

Both sterling and UK gilt yields have initially moved down sharply in response to the data, which are seen as weakening the case for further interest rate rises from the Bank of England. However, BoE policymakers will also be mindful of evidence of a gradual increase in domestic inflationary pressures. These domestic considerations still make it likely that the BoE would likely hike interest rates by 0.25% to 0.75% at its May meeting.

On the flips side, the Bank of Canada (BoC) has become more meticulous again as CAD appreciated heavily following two rate hikes, but then, monetary policy to be more decisive than oil prices in the days to come. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices.

However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor. CAD rates recently climbed above USD rates for the first time since 2014.

In view of numerous risks (inflation, oil price, NAFTA) the BoC does not want to be overly optimistic.

We assume that for the time being the BoC will initially follow the Fed’s rate hike speed so as to prevent strong CAD appreciation against USD. The better growth outlook in Canada, as well as the more stable political environment, will, however, allow gradual CAD appreciation in the future.

Option Strategic Framework:

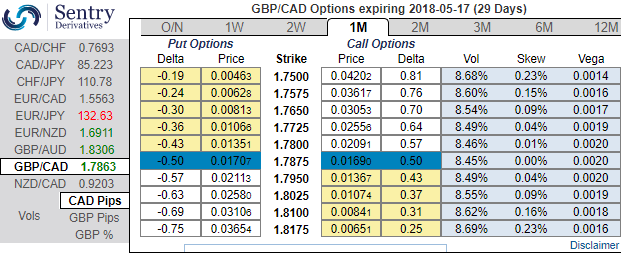

Please be noted that the positively skewed IVs of 1m tenors of this pair is well balanced on either side, technical trend (both minor & major) and above stated fundamental driving forces of this pair have been indicating perplexities which means hedgers’ sentiments of this pair may head towards any directions with more potential on downside in near term.

Accordingly, we advocate below options strategy that is likely to optimize hedging motive.

Strategy: 3-Way Options straddle versus OTM call

Spread ratio: (Long 1: Long 1: Short 1)

How to execute: At spot reference: 1.7856, initiate long in 1M GBPCAD at the money +0.51 delta call, add one more lot of 1M at the money -0.49 delta put and simultaneously, short 1w (1%) out of the money call with positive theta. The short leg with narrowed expiry (lower side) likely to reduce total hedging cost.

Currency Strength Index: FxWirePro's hourly GBP spot index is at shy above -107 levels (which is bearish) on prints of disappointing UK CPI (actual 2.5% versus consensus and previous 2.7%), while hourly CAD spot index is edging higher at -27 levels (mildly bearish) while articulating (at 10:12 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis