Prime Minister May surprised the market by calling for a snap general election on 8 June.

The possibility of a hard Brexit has already been discounted by the market, but the larger parliamentary majority currently implied by the polls would strengthen the UK government’s negotiating position domestically.

The market is now assigning better odds to a post-Brexit EU-UK trade agreement, and thus the worst may be behind us and cable short covering may just be starting.

For longer-expiry GBP vols, two questions are more pressing:

Firstly, whether snap elections constitute a game changer for the medium-term sterling trend –a 180-degree turn in a long-held macro view, especially from deep levels of currency under-valuation, can drive vol materially higher via sustained directional demand for options as we learned from the Abenomics experience; and

Secondly, whether relatedly, fundamental sterling FX uncertainty has increased even as domestic UK political uncertainty has decreased, as anecdotally indicated by the dispersion of views in internal and client conversations on implications of a larger Tory majority for actual Brexit negotiations.

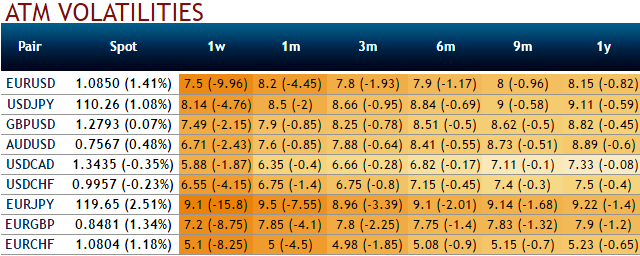

The jury is still out on both questions and there is little sense in risking vol shorts this early in the game and this side of French elections, especially when current implied vol levels do not offer particularly outsized compensation to assume that risk (EURGBP 1Y ATM below 8%, near 2-yr lows).

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data