AUD has been a longstanding favored short candidate on the view that persistent inflation undershoots, lack of wage pressures and labor market weakness will prevent the RBA from participating in the reflation theme; because it functions as an all-weather hedge against geopolitical ructions or garden-variety equity weakness; and since it offers much better value than its antipodean counterpart (NZD) where the JPM view is downbeat but which has already de-rated significantly after the elections.

From an options standpoint, it helps that negative carry of short AUD positions has dwindled close to zero, and the entrenched history of underperformance of AUD risk-reversals and flies motivates the use of zero-cost seagulls as bearish AUD seagulls.

This still remains the right structure in our view, even though the value in selling flies has largely disappeared after their normalization from a short-lived Q3 spike. For instance, 6M 0.76 – 0.73 put spreads financed by selling 6M 0.7850 calls are zero cost (spot ref. 0.7676).

CLP is a recent underweight recommendation from our LatAm team on poor valuations, negative balance of payment dynamics and the passage of a positive short-term political catalyst.

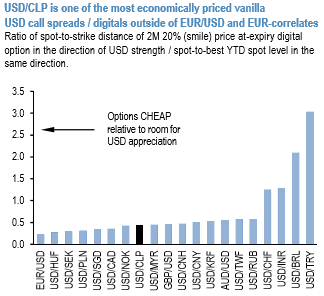

The option RV edge is that CLP is one of the best value currencies to position for USD strength, based on a comparison of the spot-to strike distance of 2M 5:1 geared digital USD calls with the distance from current market to the most extreme YTD USD-bullish spot levels (refer above chart).

The latter acts as a proxy for the extent of maximum USD appreciation room and is far from perfect as a deflator, but crudely maximizes utility for a value investor in search of laggards.

Like CHF and AUD earlier, selling CLP entails minimal interest rate carry (points are negative up to 3M tenors), and its relative liquidity within the Latin region offers the potential for the currency to be increasingly used as a proxy hedge against higher yielding investments in the region.

USDCLP 3M 30D risk-reversals (strikes 652 vs. 622 off spot ref: 628) cost 20bp, where the short strike is well-located near YTD spot lows.

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges