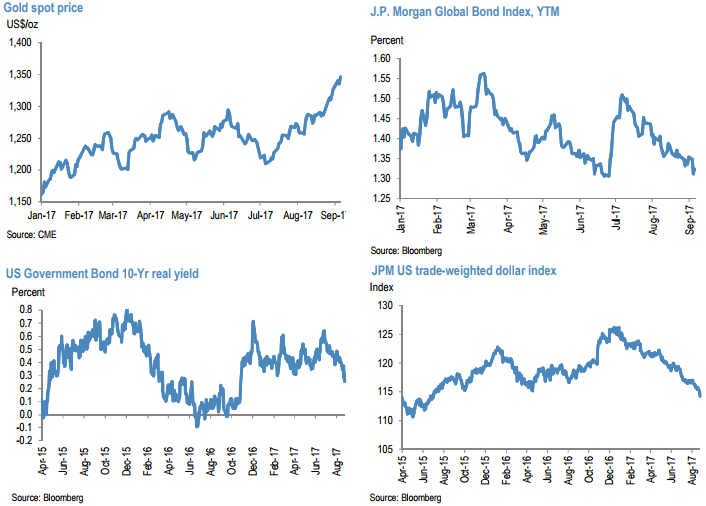

Gold has decisively broken out of its previously established narrow range, pushing through the $1,300/oz ceiling it had previously unsuccessfully attempted to rise above three times prior since April (refer above diagram). Volatility has also picked up.

The march higher is two months old now and began in July when disappointing inflation readings across DM countries reinforced the willingness of central banks to pull back from their tapering mode signaled in June, thus triggering a rally in global bonds. This week, global bonds have almost fully completed an unwind of their June sell-off (refer above diagram). Accordingly, at 2.05% the yield on the 10-year US Treasury note is now back to pre-election lows, off its 2.38% highs in June when gold was trading down towards lows $1,200/oz.

Consequently, the US dollar has shifted another leg lower in the last two months (refer above diagram). Real yields have also come sharply down despite stronger global and US growth (refer above diagram). Five consecutive downside misses on US inflation versus expectations have resulted in lower expectations for another Fed hike this year, with the implied odds of another rate increase in 2017 slipping to 25% from about 48% two months ago.

Bonds have continued to rally in September, with yield curves flattening further on the escalation in geopolitical tensions. While elevated political risk does add to the gold's allure, our short-term valuation model shows that the sharp drop in real yields from 0.64% in the first week of July to 0.256% currently is almost fully responsible for the $140/oz price appreciation of gold in the last two months. We continue to see an eventual upturn in inflation.

Granted, inflation has been slow to normalize, but without any signs of improved productivity growth, the new-found love for gold has been expressed both by inflows into gold ETPs and through notable growth in speculative longs on the COMEX. In the last two months, investors have increased their outright long positions from 13.1 mn oz in early July to 24.5 mn oz as of last week—significantly above average length of 15 mn oz since 2006. Over the same period, investors have also trimmed their outright short gold positions by 8 mn oz, increasing their total net length over six times

OTC updates:

The IVs of XAUUSD has shrunk away but well above 11%, while the hedging interests for upside risks remain intact as you could make out from the positive risk reversal flashes along with the corresponding noticeable spike in IVs across all tenors.

Hedging framework: Add longs in 3M vs staying short in 6M 180:100 vega-weighted gold straddle calendars (vol pts). We see better value in looking for curve flattening as tighter fundamentals compete with increased producer hedging the coming weeks as spot prices flirt with $1285-1300.

Alternatively, we advocate longs in mid-month tenors on hedging grounds, In bullion market, gold futures (Comex) trimmed $5.85, or around 0.44%, to $1,322.57 a troy ounce.

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings