July trade and tourism data were better-than-expected, but only at the surface. Deeper down, they highlighted intensifying worrisome aspects for the economic outlook. The trade deficit improved from June, but only because imports fell by an especially sharp 20% YoY.

What markets should be more interested in is the 12% YoY contraction in exports, which matched earlier guidance from export associations, but contradicts recent statements by policymakers that exports were rebounding. As far as tourism is concerned, foreign arrivals were down 37% YoY.

Turkey's trade deficit declined by 32.5 pct to $4.79 billion in July of 2016, compared to a $7.1 billion gap a year earlier. Exports went down 11.5 pct to $9.8 billion, due to lower sales of manufacturing products.

The significance of the data is that July and August constitute the major tourism season of the year and account for a third of annual arrivals. Shortfalls in these months cannot be made up in later months.

The slide began before the coup and was driven by broader security concerns which have not disappeared – against this background, the restart of Russian tourism is likely to provide only minor support. Weaker real economy data will only intensify political pressure on CBRT to cut rates quicker: we foresee USDTRY at 3.25 by year-end.

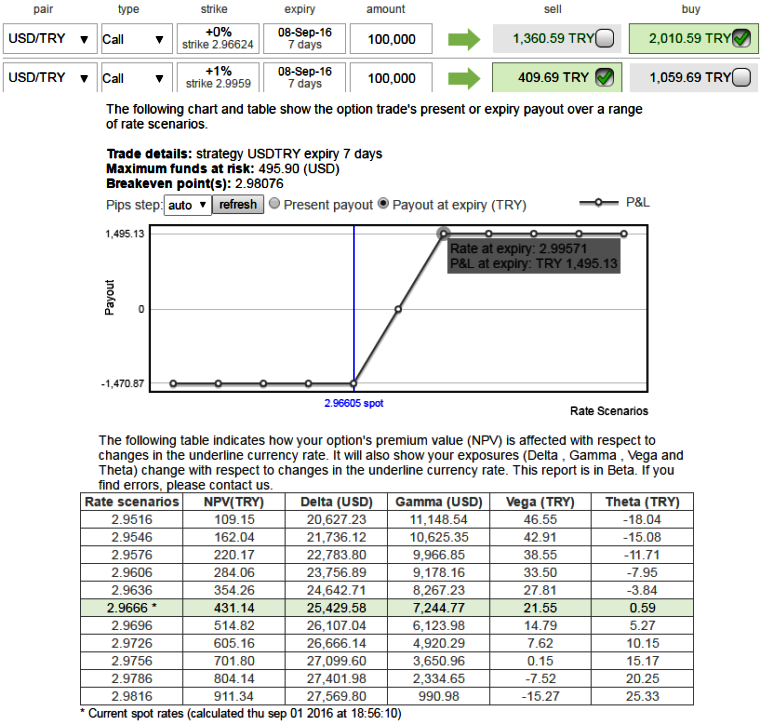

Hedge to Arrest Uncertain Fx Risks With Reduced Costs:

Margin: Not needed for Calls

Execution: Go long in 2M (1%) ITM +0.67 delta call, and simultaneously short 2W (1%) OTM call with preferably positive theta or closer zero.

The Delta is continuously varying as the underlying spot FX fluctuates. Options further in-the-money (ITM) have a higher Delta. This indicates that ITM options are worth more per pip movement in the underlying market and out-the-money options are worth less per pip.

Strategy run-through:

One can use this strategy upon the expectation of trading or even on hedging grounds that the underlying spot FX USDCHF would rise in the long run but certainly not with drastic pace in short run. Even if it goes against, the maximum loss is limited by OTM strike price. having shorts in this strategy capitalize on reducing vols and initial premiums that we receive would finance for the long position.

Risk/Reward Profile: The profit is limited by OTM strike price, No matter how far the market moves above, the profit remains the same.

Please be noted that the tenors shown in the diagram are for demonstration purpose only.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX