Things are never as bad as they first seem, following Donald Trump’s election victory there were many predictions of gloom for Mexico.

Six months later things did not turn out quite as badly (yet). Trump still wants to build a wall on the border with Mexico and wants to re-negotiate the NAFTA agreement but the US administration sounds more conciliatory these days.

Also it has become clear over the past weeks that some things are not that easy to implement. From that point of view it comes as no surprise that MXN has been able to recover notably since the start of the year.

We nonetheless remain cautious regarding the peso. Even if the worst case scenario does not materialize the US administration’s new immigration and trade policies are unlikely to bypass Mexico completely.

However, short term MXN can benefit from the currently very positive sentiment towards EM currencies.

Hedging Strategy:

Sell 3M USD/MXN 25D RR, after weekend’s correction in USDMXN from the highs of 19.7210 levels, the pair sensing little support lower BB (i.e. around 19.0690) and showing strength to resume its previous bullish rallies, for now, the major uptrend appears to be little cranky.

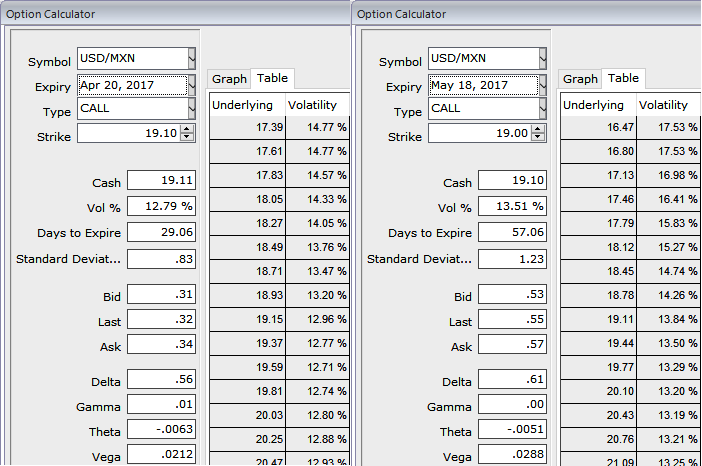

While ATM IVs of this pair is substantially spiking higher above 12.75% and 13.5% for 1m and 2m tenors which is conducive for the holders of the call options, but using the minor dips in this underlying pair writing narrowed tenor OTM calls would reduce the cost of hedging.

Thus, using any abrupt dips, initiate a diagonal debit/bull call spread (DDCS) at net debit.

The execution: Initiate shorts in 1m (1%) out the money calls with positive theta, simultaneously, buy 2M (1%) in the money 0.51 delta call option. Establish this option strategy if USDMXN spot FX is either foreseen to be in sideways or spike up considerably over the next month but certainly not beyond your upper strikes in short run.

As shown in the diagram, a typical call spread likely to fetch yields as long as it keeps spiking upto OTM strikes, which is why we’ve chosen shorter tenors on short leg and advocated longer tenor on long leg.

Please be noted that the tenors shown in the diagram is just for demonstration purpose only, use accurate tenors as stated above.

Banxico's efforts to stabilize the MXN through intervention last week are a short term fix, but insufficient to knock out sticky medium term long USDMXN positions.

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch