Australia' trade deficit widened to AUD 0.63 billion in November of 2017 from a downwardly revised AUD 0.30 billion in the prior month and missing market consensus of an AUD 0.55 billion surplus.

There were also downward revisions to the past few months, with the September and October prints each lowered by close to A$400 million. Indeed, the November data amplify the moderation in the external sector since midyear, particularly compared to the record surpluses posted in late 2016 and early 2017.

Although November’s trade data were considerably weaker than we had expected, we remain upbeat on the near-term prospects for Australia’s external sector given the anticipated surge in LNG production and accompanying pickup in export growth.

Most of the major projects currently under construction are expected to be completed by mid-year, meaning the impulse from rising export volumes should dissipate in 2H’18, at which point Australia’s trade data will become even more diligently fastened to commodity price performance.

While as per the JP Morgan’s projections, AUDJPY would be seen at 79 by Q1’2018.

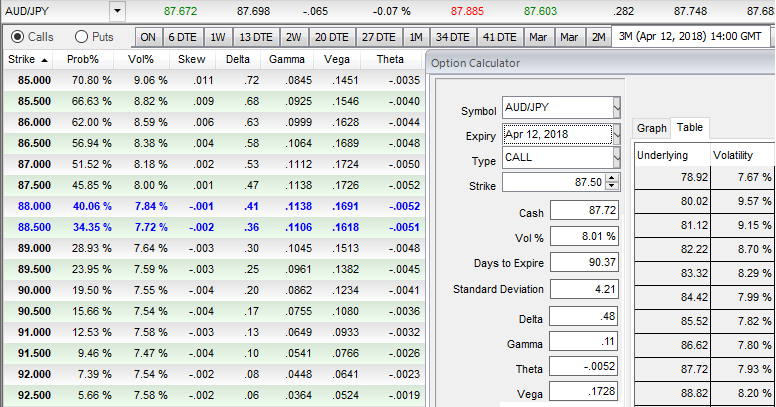

Hedging framework (AUDJPY):

Vols of 3m tenors are also at a decent side which is conducive for option holders, while skews have positively stretched on OTM put with attractive gammas, this Options Greek is the rate of change of the Delta with respect to the movement of the rate in the underlying market. In the Sensitivity table, Gamma shows how much the Delta will change if the underlying rate moves by 1%. Hence, we’ve chosen ITM striking put as we agree with JP Morgan’s projections.

Contemplating these aspects, on hedging grounds, risk-averse traders, capitalizing ongoing rallies of the underlying spot FX, we advocate snapping rallies and buying a 4M 84.250 AUDJPY one-touch put.

Please be noted that the 3m ATM IVs of this pair is trading shy above at 8%. While (1%) OTM put seems to be overpriced at 7% more than NPV which is in tandem with IVs of this tenor.

Those who wish to reduce the cost of hedging; we advocate buying 4M sell 2M AUDJPY put spreads at 89/84.250 strikes in 1:0.753 notionals.

Currency Strength Index: FxWirePro's hourly AUD spot index is flashing at 82 levels (which is bullish), while hourly JPY spot index was at shy above 129 (bullish) while articulating (at 05:20 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?