The only EMFX vol that has retorted marginally to the prevailing EMFX turmoil in the complex is USDKRW.

A quick glance at some key South Korean fundamentals: The government has to rethink its economic policies after the unemployment rate (after seasonal adjustment) hit the highest since 2010 at 4.2% by end-August. The biggest job losses are seen in manufacturing and retail sectors. However, the spike-up of jobless rate is not a reflection of the escalating trade tensions, though. Finance Minister Kim Dong-Yeon said this morning that the government will consider adjusting the pace of minimum wage hike. Regarding the market implications, the soft job data indicate that the rate hike process could be postponed further. We think that a rate hike is hardly on the table this year, which is KRW negative ultimately.

Korea’s hefty current account surplus has insulated it to a large extent from the pain engulfing the deficit names in Latin America and EMEA, heavy equity outflows since 1Q’18 have reduced vulnerability to capital flight and 4Q tech seasonals could support inflows over the rest of the year.

Still, the resilience of the won to trade tensions so far, given its traditional status as a high-beta Asian currency, has been remarkable and we attribute at least a part of it to the ongoing strength in US equities.

The open question is whether this happy state of affairs can survive an intensification of US/China trade frictions and/or broader EM turmoil; what we think is not in question is that risks around the current benign baseline are one-sided and unpleasant.

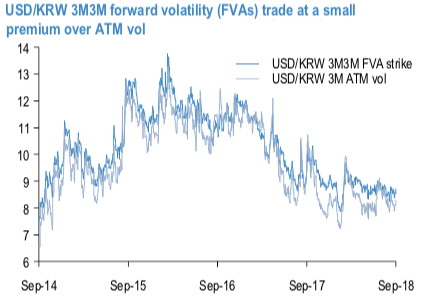

Possessing KRW vol from current levels is consequently an asymmetric hedge against a worsening of risk sentiment. As the running implied – realized cost-of-carry of outright option longs is substantial, we propose buying 3M3M forward volatility (FVA) that is priced at only a small premium (0.4 % pts.) over 3M ATM vols (refer above chart). Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is inching towards -68 levels (which is bearish), while articulating at 12:35 GMT. For more details on the index, please refer below weblink:

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed