The summary of the BoE meeting in March contained three main triggers for changes to the BoE’s current monetary policy stance.

1. CPI inflation. 2. Wage growth. 3. Private consumption.

• Higher CPI inflation and/or higher wage growth than currently expected would increase the likelihood of a hike.

• Slower private consumption growth than expected would increase the likelihood of a cut.

In line with our expectations, the Bank of England (BoE) made no policy changes at its March meeting and reiterated its neutral stance by repeating it could move ‘in either direction’.

• However, there was a hawkish twist. First, Kristin Forbes (a known hawk) voted for a March hike. Note, though, that she is leaving the BoE on 30 June 2017, which makes her hawkish stance less important. Second, the statement revealed that ‘some members noted that it would take relatively little further upside news…for them to consider that a more immediate reduction in policy support might be warranted’.

• We still expect the BoE to remain on hold for the next 12 months. While we think it is unlikely the BoE will tighten monetary policy in a time of elevated political uncertainty, we think we need to see substantially slower growth and/or higher unemployment before easing becomes likely again. Also, BoE Governor Mark Carney has said that one of the reasons the UK has been resilient to Brexit uncertainties so far is due to the significant monetary easing from the BoE.

• Note that the BoE reaction function has changed since the financial crisis: BoE puts more weight on growth/unemployment relative to inflation.

In our view, the BoE seems to be more worried about slower growth than too-high inflation if this is only temporary.

OTC Outlook:

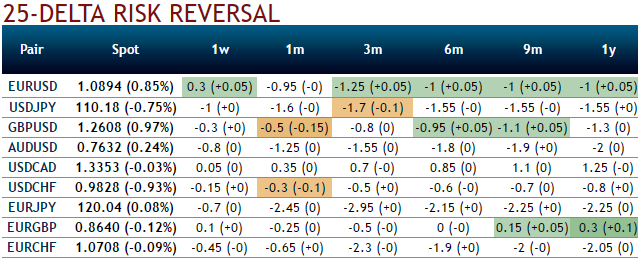

Delta risk reversals of EURGBP: As a result of that macro theme and central bank’s driving forces, from the nutshell showing delta risk reversals of EURGBP, you can probably make out that the pair has been one of the most expensive pairs to be hedged for upside risks as it indicates calls have been relatively costlier over puts but hedging sentiments for upside risks are intensified in 1 year tenor.

Needless to specify, GBP vols have still been flying high pace no matter what both prior and post-Brexit events, but this time these IVs are also owing to BOE’s monetary policy decision.

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings