NZDUSD has continued its consolidation phase since last May to take rallies upto 0.7519 (i.e. 50% Fibonacci retracements from the lows of 0.6196). For now, it has managed to broke below 0.7170 minor support, signaling a move to 0.7130 (end-Aug low), but 0.7130-35 is the key barrier for aggressive bears. Uncertainty around dairy prices and the election, as well as a USD recovery, continue to weigh in long run.

NZDUSD in medium-term perspectives: If the RBNZ remains firmly on hold, as we expect, and the US dollar rises on tighter Fed policy, then NZDUSD could fall as far as 0.70 by year-end.

Hedging framework:

OTC Outlook and Options Trade Recommendations:

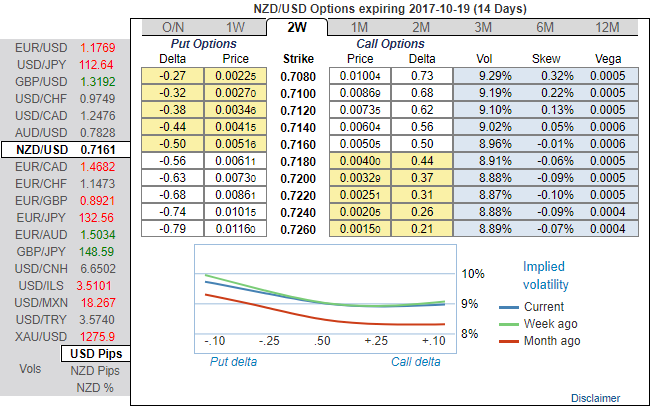

All the factors stated above seem to be discounted in FX options market, please glance through nutshell evidencing IV skews that signify hedger’s bearish interests in next 2-months timeframe. Positively skewed IVs of this tenor signal underlying spot FX is expected to be either edgy with sideways swings or lowering southwards as the skews have been well balanced flashing positive numbers on both OTM and ITM strikes.

Also be noted that at spot reference: 0.7160, the 2m skews are targeting OTM put strikes at 0.6950, whereas 2w positive skewness is still showing hedgers’ interest on ATM stikes.

Accordingly, we’ve recommended credit put spreads in order to participate both upswings in the consolidation phase and anticipated downside risks.

We recommend writing 2w (1%) in the money put with positive theta snapping decisive rallies. You could easily make out short legs on ITM puts of narrowed expiries are going worthless considering time decay advantage. Simultaneously, we uphold longs in 2m (1%) out of the money put, the structure could be constructed at the net credit.

Theta shorts are recommended in this strategy because Theta is not a constant, it changes as the underlying market moves and time passes. Theta is the sensitivity of an option’s value to the passage of time. It is usually expressed as the change in value per one day’s passage of time.

Upon the mounting bearish risk, sentiments are observed as you could see the positively skewed IVs in OTM put strikes of 2m tenors (refer positive IV skews indicate the strikes towards 0.6950 which is 50 pips below our forecasts).

The combination of IV 1-3m skews suggested credit put spreads that have favored to arrest ongoing upswings in short run and bearish risks are to be taken care by 2m OTM longs.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate