The break of 8.0 on USDJPY 1Y ATM vol back in December had caused a frisson of excitement among vol accounts looking to buy Yen vega as a strategic late cycle FX vol play, but what was deemed to be a key technical support level has long since been left in the dust. 7.0 now looms as the next major target, beyond which there is still substantial room to fall to revisit pre-GFC levels in the 6s. It is difficult to argue with option prices steadily softening when the spot is stuck in a tight 109-111 range and delivering 2-2.5 pts. below implieds. There is also a case to be made that the ongoing softness in realized vols can continue longer than some anticipate, since the propensity of the Yen to rally in market downturns is being dampened by a cyclically wide US-Japan interest rate differential that is fuelling above-average equity and FDI outflows, alongside a reduction in FX hedge ratios of traditionally well-hedged foreign bond purchases.

As is almost always the case around this time of the year, such realized vol drags are being exacerbated by drip supply of vega from Japanese importers who are beginning to add to USD-buying FX hedges with embedded short optionality on downticks in USDJPY spot.

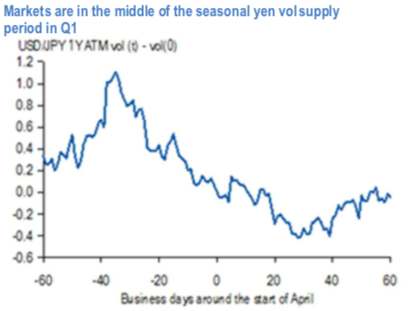

Over the past few years, much of this flow has been well-known to be concentrated in and around the Japanese fiscal new year at the end of March, which imparts a distinct bearish seasonality to the behavior of yen vol in Q1 and early Q2 (refer 1stchart). The magnitude of this seasonal decline is substantial: the average peak-to-trough dip of 1.4 % pts. over a 3-month period centered around March 31stsuggested as shown in 2ndchart that is in excess of 1-sigma of quarterly variability of Yen vol over the past decade. Anecdotal accounts suggest that transactions in such hedges are also turning increasingly tactical i.e. spot USDJPY level dependent, with the result that corporate vega supply, even if in smaller clips outside of the peak months, is becoming something of a persistent feature of the market. While difficult to quantitatively compare with the 2006/07 period in the absence of publicly available transaction data, this corporate flow bears shades of the well-known Uridashi-driven vol supply of the pre-GFC years that had pressured USDJPY 1Y vol to all-time lows in the mid-6s by late 2006.

We are also given to understand that the 2019 vintage hedges have been extremely light so far, implying that the decline in Yen vol YTD has largely been a global macro risk premium compression story with almost no idiosyncratic flow assistance from importers. This, and the fact that we are deep in the middle of the traditional FX hedging season, renders any notion of purchasing Yen vega premature. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly USD spot index is flashing 0 (which is absolutely neutral), while hourly JPY spot index was at 107 (highly bullish) while articulating (at 05:30 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices