The EU will most likely grant the Brits another extension of their EU membership as could have been expected and as the current news flow suggests.

As a result Thursday (the date for which Brexit was originally planned) is no longer a relevant date for the GBP exchange rates. But nonetheless Brexit cannot be priced out. The government and parts of the opposition want elections as soon as possible. Labour does not, how they want to convince their electorate of that position remains the secret of the British Labour Party.

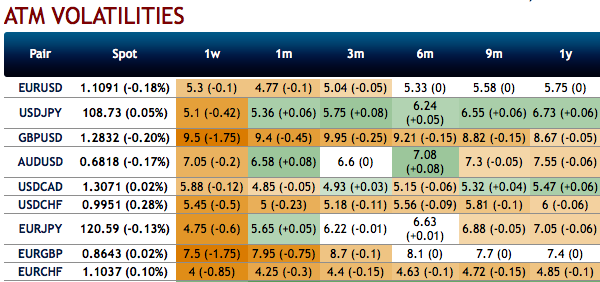

After the elections everything would be wide open once again. Elections would de facto constitute a renewed referendum on leaving the EU. Following the experience of 2016 nobody dares to make projections any longer. At least not the FX market, and to be on the safe side it is therefore pricing in significantly increased GBP volatility for the period of 1 to 2 months. And it sticks to its view: the event risk constitutes a significant risk of a GBP collapse (in case the Brexiteers were to dominate the House of Commons after the elections): extreme events at the upper end in EURGBP can only be hedged at significantly increased premiums. At the lower end (i.e. towards GBP strength) there is not much expected. The insurance premiums are relatively small, relatively similar for 25% events as for 10% events. Regardless of what happens the market assumes that in case of a GBP positive outcome Sterling strength will be moderate. GBP weakness on the other hand would be quite considerable in case of the elections leading to a relatively hard Brexit.

Of course, continued Brexit risks also putting pressure on the European currency, but only marginally so. The market does not see a major event risk for the European single currency.

Just quickly glance through above implied volatility (IV) nutshell before deep diving into the strategic frameworks.

Otherwise 3M EURUSD-volatility would hardly be stuck around the 5% mark. If one ignores GBP volatility though the FX market has returned to the vol lows seen last summer. The hopes are lingering that the vol levels seen at the time would be short-lived was correct in the sense that volatilities rose significantly in August. However, there is no sustainable escape from the structural low volatility environment - that much has become clear.

That is seemingly positive for all those for whom FX is an undesirable risk. However, things become dangerous if the exchange rates no longer reflect fundamental data in a sufficient manner. Is that possible on the FX market considering the breath-taking turnover? If market participants consider low liquidity to constitute one of the biggest risks (as polls among market participants suggest) then we do have to worry about that.

IV factor is highly imperative in FX option dynamics because the option pricing significantly depends on future volatility, and it is quite impossible for any veteran to ascertain accurate future volatility.

Contemplating low IV environment, on trading grounds, we recommend executing butterfly spread.

So, buy 1m EURUSD OTM -0.49 delta put while simultaneously shorting ATM put of similar expiries and 1m buy OTM 0.51 delta call while simultaneously shorting an ATM call with similar expiries. This strategy is structured for a larger probability of earning a smaller but certain profit as EURUSD is perceived to have a low volatility. Courtesy: Commerzbank

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom