The two main overnight movers were the NZD and the CAD. The NZD is under pressure on the back of dovish rhetoric from Governor Wheeler, while the CAD reversed its oil price following gains after Moody’s downgraded several Canadian banks.

From last three months, GBPNZD is showing more upside potential even though it has been losing upswings momentum as the rejection of resistance at 4.0180 levels.

The focus today is obviously on the BoE. External MPC member Kristin Forbes will probably continue her hawkish dissent in favor of an immediate interest rate hike. However, given the greater-than-expected slowdown in GDP growth in Q1 and continued signs of moderate wage growth, in our view, it is unlikely that she will be joined by any other member.

The accompanying release of the Bank’s Quarterly Inflation Report is likely to reaffirm that the committee remains in wait and see mode for now. CPI inflation over Q1 as a whole overshot the projections made in February, which is likely to force an upward revision to the 2017 CPI projection

But the intraday trend has been sensing slight weakness at the peaks of 1.8962 levels.

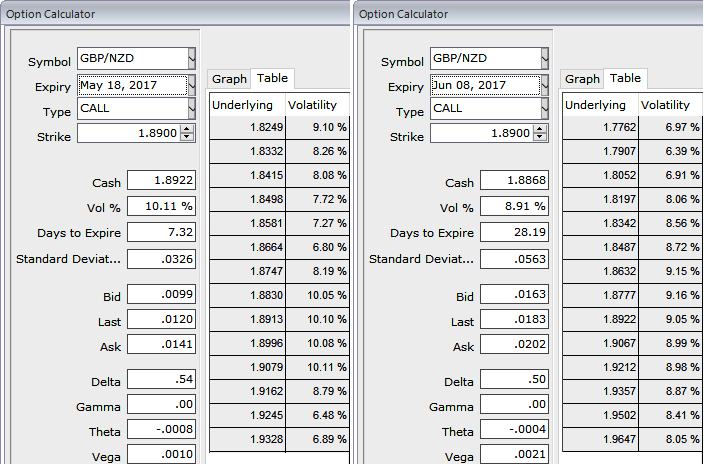

Well, in GBPNZD options, let’s say the vega of the long leg (buy) call option position is 100 NZD and it implies that if IV increases or decreases by 1%, the option’s premium would have an impact in an increase or decrease by 100 NZD, respectively. The Vega of a short (sell) option position is negative and an increasing IV is bad. Please be noted that the 1w IVs are just a tad below 10.11%, and overpriced ITM calls could be written off in our strategy.

We now keep an eye on decisive breach strong support at 1.8869 levels, options straddle is the best suitable in such turbulent option market circumstances, hence we load up longs in the call as well as the put with 50% delta. So, go simultaneously long in at the money call and, and limited risk to the extent of initial premiums paid options,

Long options straddle that is likely to fetch unlimited yields during higher implied volatility scenarios amid BoE’s.

Well, this options trading strategy that is used when the options trader ponders that the GBPNZD would experience significant volatility in the near term but expects the swings in either way.

Alternatively, although we could see some sort of bearish sensation we project the GBPNZD outlook to be in the range with major trend goes in the consolidation phase, the recommendation is to go long in 2M ATM delta +0.51 call, and simultaneously short 2W (1%) ITM call for the net credit.

The lower strike short calls to reduce the cost of hedging, this would help in purchasing of at the money long calls and this strategic position is entered to reduce the cost of hedging.

Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes