All those who fear a strong franc, above all the Swiss National Bank (SNB), should be just as nervous at the moment as regards Brexit. EURCHF is once again approaching last year’s low just below 1.12, driven of course by increased risk aversion as a result of global economic concerns.

In case of a hard Brexit, the 1.10 level is likely to be reached very quickly again. And in fact, we would then expect the SNB to intervene on the markets, preventing a stronger collapse of the EURCHF exchange rate. It is likely to achieve that as long as the situation stabilizes again quite quickly, which is quite possible as the negative real economic effects of a hard Brexit are likely to be more manageable than many fear.

OTC updates and trade recommendations: (Short in EURCHF via ITM put options, spot reference: 1.1223 levels).

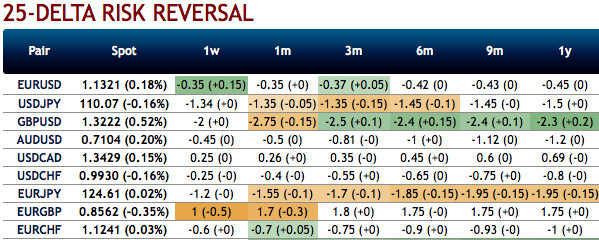

EURCHF bearish neutral risk reversal numbers and positively skewed of implied volatilities of 3m tenors signify the bearish risks to prevail further.

25-delta risk reversals indicate the difference in volatility, and therefore price, between puts and calls on the most liquid out-of-the-money (OTM) options quoted on the OTC market. Negative bids indicate puts are more expensive than calls (downside protection is relatively more expensive).

Accordingly, we advocate 2m (1%) in the money -0.79 delta put options, the rationale for choosing such derivative instrument is that the in the money put with a strong delta would move in tandem with the underlying downward moves. Courtesy: Sentrix, Saxo & Commerzbank

Currency Strength Index: FxWirePro's hourly EUR spot index is inching towards -168 levels (which is bearish), while hourly CHF spot index was at -77 (bearish) while articulating (at 13:10 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close