As the market gradually adjusts to the idea of policy tightening by the ECB, it is useful to consider the options ahead for the Swiss National Bank (SNB). Switzerland is entirely enclosed by the euro area, which is its largest trading partner and so is likely to share in the brightening growth and inflation outlook of the single-currency area. But its current policy setting is constraining the SNB’s policy options.

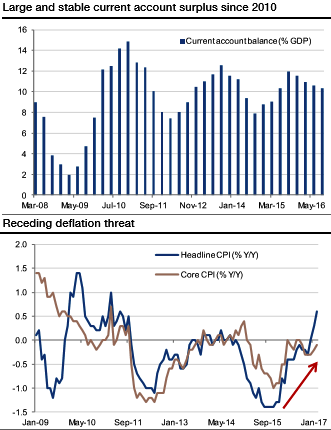

What is striking about the Swiss franc is that notwithstanding the SNB's repeated assertions that it is "significantly overvalued", there is a little economic impact from said overvaluation. The Swiss current account is the largest among the G10 economies, and it has averaged over 10% of GDP in the past few years despite the franc's sharp appreciation (see above chart).

The monthly trade balance in franc terms has been persistently higher since June 2015 than before the EURCHF floor policy was abandoned in January 2015. Notwithstanding complaints from exporters about the franc's value, Swiss economic growth has been decent, and the outlook appears favourable. The unemployment rate has been stable over the past year and remains well below the spike seen in the aftermath of the 2008 global financial crisis.

More importantly, CPI inflation readings have been trending up since late 2015 (now at 0.6% YoY). Although Swiss core inflation is lower at -0.1% YoY, it is also off the low of -1.0% in late 2015 (see above chart). The SNB's latest monetary policy outlook recognized the inflation uptick, and it is now forecasting headline inflation rising to over 1% in 2019. Switzerland, therefore, appears to fit well within the broad European reflation story.

To put it plainly, there seems to be a little serious economic consequence from the franc's supposed overvaluation. The combination of the dissipating deflation threat and the brightening growth outlook is weakening the urgency of maintaining the ultra-loose monetary policy in Switzerland.

However, the dangers posed by policy normalization to the SNB have grown significantly. The uptrend in the sight deposits of domestic banks indicates persistent SNB intervention to support EURCHF after January 2015. Sight deposits provide the funding for the SNB's foreign reserves hoard and are a liability on the SNB's balance sheet. They have continued to rise despite the levy of a -0.75% interest rate. SNB intervention is confirmed by the persistent rise in Swiss foreign reserves, which are now the third largest in the world (at $666bn), and growing. Swiss foreign reserve holdings grew CHF60bn in 2014, CHF64bn in 2015, CHF86bn in 2016 and CHF23bn in the first two months of 2017. The acceleration of reserves accumulation by the SNB is the testament to the acute appreciation pressure on the currency (see above chart).

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target