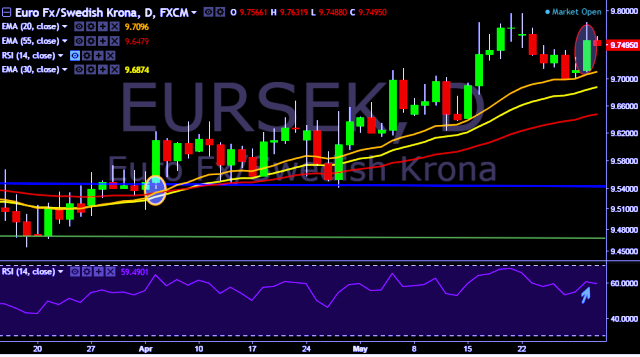

- EUR/SEK is currently trading around 9.7537 levels.

- It made intraday high at 9.7631 and low at 9.7492 levels.

- Intraday bias remains bullish till the time pair holds key support at 9.7096 mark.

- A sustained close above 9.7566 tests key resistances around 9.7662, 9.7752, 9.7974, 9.8295, 9.8346 and 9.8555 marks respectively.

- Alternatively, a daily close below 9.7566 will tests key supports at 9.7492, 9.7364, 9.7096, 9.6774 and 9.6543 marks respectively.

- Important to note here that 20D, 30D and 55D EMA heads up and confirms the bullish trend in a daily chart.

- Yesterday Sweden released GDP as well as retail sales data.

- Swedish Q1 GDP +0.4 pct qtr/qtr vs median forecast of +0.8 pct in poll.

- Swedish Q1 GDP +2.2 pct yr/yr vs median forecast of +2.7 pct in poll.

- Swedish April retail sales +1.3 pct month/month vs forecast +0.7 pct in poll.

- Swedish April retail sales +4.5 pct year/year vs forecast +2.8 pct in poll.

We prefer to take long position in EUR/SEK around 9.7420, stop loss at 9.7096 and target of 9.8295.